Fintech investments

Developing safer, faster, fairer financial systems

Meet our Fintech investment team

Who we’re backing

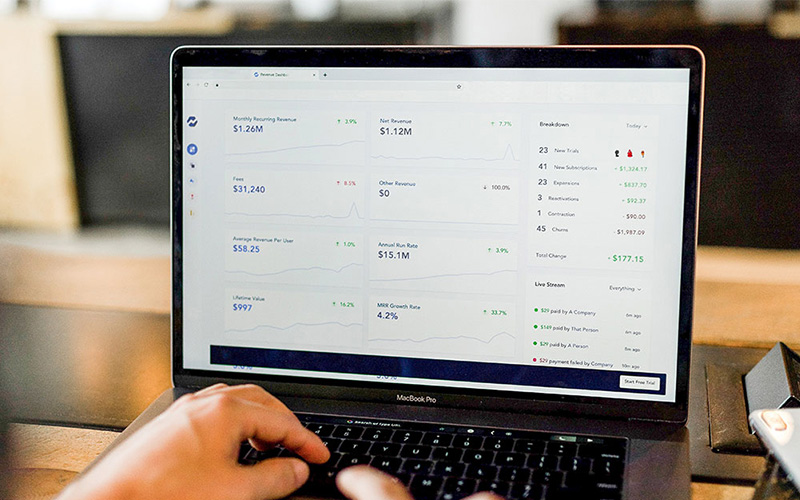

We stand with the startups that are redefining financial services, driving us toward a future of safe, efficient transactions that occur faster than the speed of thought. We back the people who are disrupting traditional services – the category-defining companies helping consumers and businesses as their relationships with money radically change. They’re breeding new tech, creating new markets and removing friction to give people better value and access to their money.

Why us?

Our Fintech portfolio is at the forefront of innovation, working towards faster and safer means of exchange, broadened access to financial infrastructure, better protection against risk, and more. Our skilled team has backed companies such as open banking payments platform Token, blockchain analytics provider Elliptic, pet insurer ManyPets and carbon accounting platform Minimum. We have an office in the US and extensive resources to help founders who are based or expanding there.

The investment process

These are the general steps we follow – note that the process is slightly different at the pre-seed stage of investment.

Step 1

Send us your deck – if we think we’re a fit for your business, we’ll set up a call

Step 2

Meet some of our investors at a discovery meeting

Step 3

We’ll visit you at your office and spend some time with your team

Step 4

Present to our wider team at a partnership meeting

Step 5

We’ll tell you our final decision – if we’re not investing, we’ll say why

Our Fintech portfolio founders