The Resilience of Early-stage European Healthtech

July 2023

Since 2019, the European healthtech landscape has changed almost beyond recognition. Demand for cutting-edge solutions has transcended the individual to touch the level of health systems, insurers and employers. The enterprise value of European healthtech start-ups has surged, outstripping Asia and the US, and Europe has emerged as a key, global player.

In The Resilience of Early-Stage European Healthtech we set out to explore the continent’s rapidly changing healthtech ecosystem. We’ve called on industry leaders, from founders and investors to clinicians, to offer a comprehensive analysis of an evolving sector.

Read the report for:

- A deep dive into the European healthtech investment landscape, with a special focus on three key territories: the UK, France and Germany.

- Our analysis of the emergent trends set to change the face of healthcare, including consumer trends and pioneering new technologies.

- The go-to-market strategies we’ve seen used most effectively by founders, alongside our analysis of when to use them.

- A guide to the regulatory challenges founders face.

- Our predictions for the trends and technologies poised to make the biggest impact in 2023 and 2024.

To learn everything you need to know about the European healthtech landscape, read our report, The Resilience of Early-Stage European Healthtech.

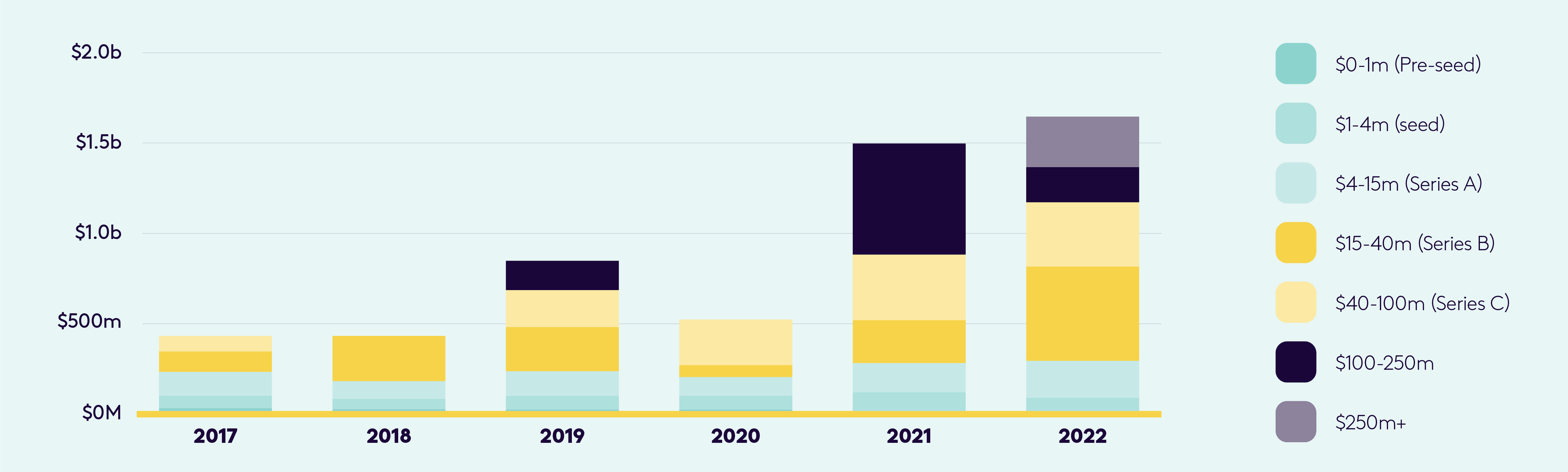

While the macroeconomic situation remains challenging, closer inspection highlights the resilience of early-stage healthtech funding.

We unpack the numbers to explore where VC funding is most concentrated, break down the biggest rounds of the year so far and look to 2022 to understand how the landscape is changing – and where opportunity lies.

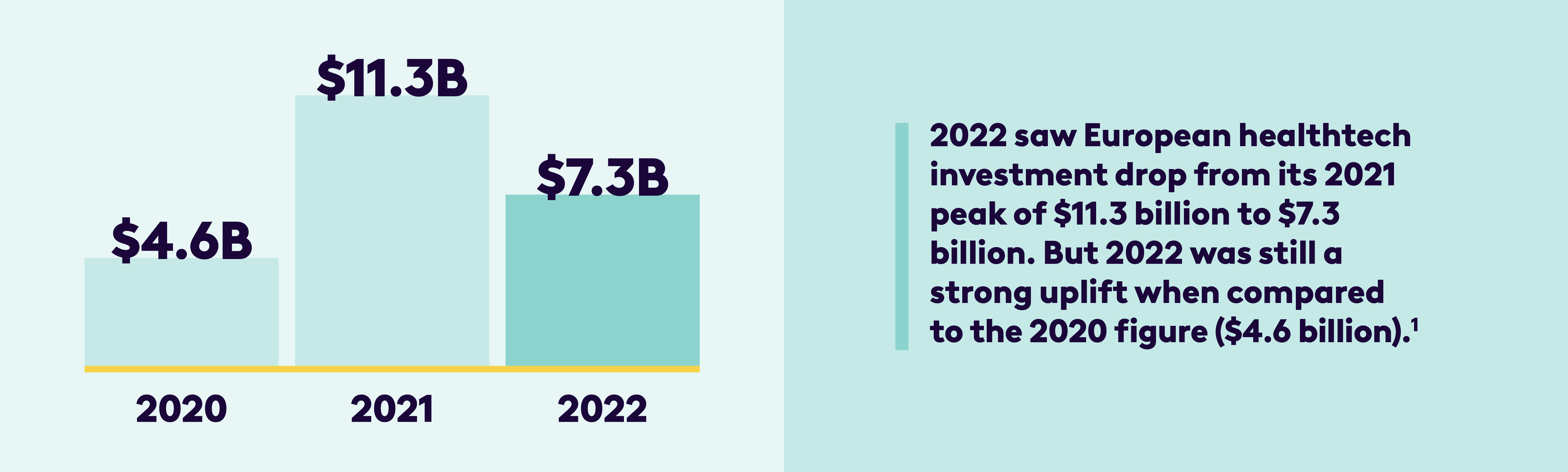

The first quarter of 2023 saw VC investment into healthtech in Europe drop from its 2022 peak1, but it was still one of the strongest in a decade. Dry powder is building across the continent, particularly in Southern and Central Eastern Europe.

With $44 billion in VC funding stockpiled2, investors and founders both find themselves in a competitive position, poised to move when the time is right.

Still, Europe is far from homogenous. Our report explores how founders can capitalise on emergent trends by region, with a deep dive into the landscape of the UK, France and Germany.

UK

The amount of VC funding invested into healthtech fell last year in the UK1 – but it still boasted the most of any European country. With the National Health Service (NHS) under threat from an ageing population with a heavy burden of non-communicable diseases3, the country is congruent with global trends – and ready for innovative solutions.

An enabling context, supported by the country’s political leadership, has already seen businesses including Palantir Foundry find success in leveraging healthtech to resolve some of the country’s key pain points. We explain the UK’s unique context, highlight points of opportunity afforded by its integrated care systems and outline some of the funding available to healthtech companies looking to enter its mature market.

“We have challenges across workforce, productivity, safety and quality of care for our patients, and just the sheer demand to be able to deliver for every patient, wherever they are in our community. We have to reimagine how we deliver healthcare, and at scale, that goes beyond the typical bricks and mortar.”

– Dr Nadine Hachach-Haram FRCS (Plast), BEM, founder and CEO, Proximie

France

Last year, two of the highest funding rounds in European healthtech signalled the emergence of France as one of most attractive countries for healthtech start-ups on the continent. With an enabling regulatory context and an appetite for revolutionary digital solutions amongst patients, France is ready for founders looking to make a population-level impact.

We look at the key figures underpinning the French healthtech landscape, share our analysis of the opportunities the country holds for founders, and highlight the areas ready for innovation.

Germany

Germany’s healthcare system generates an economic footprint equivalent to around 12% of the country’s GDP 4, but Germany is aligned with much of Europe in facing the growing challenge of caring for an ageing population living with multiple, long-term chronic conditions.

We explore some of the steps the German government has taken to provide a more hospitable context for healthtech start-ups, unpack the numbers and highlight the opportunities open to founders with the vision to connect with the change thinkers in Germany’s integrated leadership.

To learn everything you need to know about the European healthtech landscape, read our report, The Resilience of Early-Stage European Healthtech.

Resources

2 Tech.eu

3 GBD 2019 Diseases and Injuries Collaborators. Global burden of 369 diseases and injuries in 204 countries and territories, 1990-2019: a systematic analysis for the Global Burden of Disease Study 2019. Lancet. 2020 Oct 17;396(10258):1204-1222. doi: 10.1016/S0140-6736(20)30925-9. Erratum in: Lancet. 2020 Nov 14;396(10262):1562. PMID: 33069326; PMCID: PMC7567026.

The speed of change in healthtech reflects the pace of innovation. Start-ups are facilitating a reduction in patient contact time and empowering patients with a clearer understanding of their own health than ever before. As a consequence, doctors’ capacity is increasing – and patient outcomes are improving.

We take a detailed look at the four key areas of consumer trends, technology, go-to-market strategies and regulation to learn more about the impact they’re having today and how they stand to shape the industry tomorrow.

“If you can get people to engage with healthtech in a similar way to other consumer experiences, you have better access to them, can treat them more easily and are able to gather more of their data. This creates a highly personalised experience, and consumers will continue to come back.”

– Chantal Cox, Health Investor at Octopus Ventures

Consumer

Seamless digital consumer experiences have become the norm, and patients are crying out for equivalent convenience in healthcare. We look to the US, to ask what Amazon’s acquisition of OneMedical might spell for the future of healthcare, identify some of the European start-ups leveraging data to help patients manage chronic and energy-limiting conditions and explore the way digital health is paving the path to a more equitable and inclusive future.

Featuring start-ups including:

Healthtech

AI, digital biomarkers and Web3 are poised to revolutionise healthcare. We explore the impact emergent technology can have, as it blurs the line between humans and machines and uncovers new possibilities for patients and healthcare professionals alike.

Featuring start-ups including:

Go-to-market

No matter the quality of a solution, it’s the go-to-market strategy that can make – or break – a start-up. We explore four of the best strategies we’ve seen at play in the European healthtech ecosystem, highlight their strengths and weaknesses, and offer our insights into how and when founders should think about adopting them.

Featuring start-ups including:

To learn everything you need to know about the European healthtech landscape, read our report, The Resilience of Early-Stage European Healthtech.

The technologies poised to make the most impact are the ones that will allow the people at the heart of Europe’s health systems to get back to doing what they do best: caring for patients, researching the next breakthrough and building healthtech capable of meeting the continent’s biggest health challenges.

In looking ahead to 2023 and beyond, our report identifies the key areas where healthtech’s transformational potential will shine:

B2B health procurement of health digital services

Employee health and wellbeing is becoming an ever-bigger priority for industry – but businesses are frustrated by the inefficiency of procuring healthcare. We believe there’s a major opportunity for the start-ups able to streamline procurement processes and support businesses in delivering on employee health.

Featuring start-ups including:

Compliance SaaS

Regulation is struggling to keep pace with innovation. By working to simplify the complex and varied regulatory processes on the continent, start-ups can be part of the solution.

Featuring start-ups including:

Infrastructure and integration

Europe’s disjointed healthtech infrastructure presents a challenge to start-ups looking to scale. But with a near-universal appetite for integration, investment capital is waiting for founders innovating in the space.

Featuring start-ups including:

Digital screening and diagnostics

Mental illness is the leading cause of disability but has, historically, been severely overlooked. As awareness grows, there’s an enormous opportunity for start-ups offering digital screening and diagnostics.

Featuring start-ups including:

Paediatric digital health and families with additional needs

Conditions and patients that have long been overlooked are finally getting the attention they deserve, and start-ups have a pivotal role to play in providing the solutions they require.

Featuring start-ups including:

Clinical voice AIs and large language models (LLMs)

Administrative tasks occupy valuable time that healthcare providers should be spending providing patients with high-quality care. We believe that this year will see a paradigm shift in the way medical professionals use their time, as AI and LLMs step in to relieve healthcare providers of their administrative burden.

Featuring start-ups including:

To learn everything you need to know about the European healthtech landscape, read our report, The Resilience of Early-Stage European Healthtech.