Institutional crypto adoption – will it happen?

A new economy is emerging online. Its thesis is decentralisation and its method is blockchain. As the incentive structure and means of transferring value, cryptocurrencies represent an important piece of the Web3 journey. As a former equity trader, cryptocurrencies also have clear appeal as an alternative and exciting new asset: globally traded, scarce, portable and instantly settled.

Mass adoption of cryptocurrencies by financial institutions would consolidate and, in many ways, legitimise the Web3 economy. With trillions of capital to deploy, significant portfolio allocation to cryptocurrencies would undoubtedly provide a huge value inflection point for many coins and digital assets.

After what has felt like years of corporate theatre, there are green shoots of change as a number of institutions from across the capital spectrum make entrances into the crypto space. As an early-stage investor, the ‘will-they-won’t-they-and-when-if-they-do’ debate matters in order to best identify the technology, tools and platforms that could respond to and accelerate institutional demand. Over the last few months, we’ve been in frequent discussions with institutions. Issues of value, ESG and hedging have frequently come up. On the other hand, huge upside potential, client demand and competitive positioning may prove (and have already for some) sufficiently attractive pulls to enter the space.

Outlining some of the arguments below, I believe that the most interesting areas in institutional crypto at the moment are:

- The financial instruments that give investors derivative exposure to the crypto space, and the benchmarking data that facilitate these products

- New AML and KYC tools to help all institutions manage financial crime exposure from the crypto space

- Trade Data and Analytics providers that will power the next generation of crypto research desks and portfolio managers

- Segregated liquidity pools for institutions to reduce signalling and counterparty risks

I’ve highlighted some of my watch list further below. If you are building a company in this space, we would love to chat.

Pessimistic case #1 – Cryptocurrencies are an untenable store of value

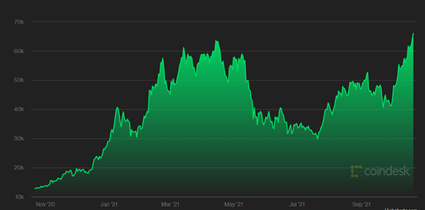

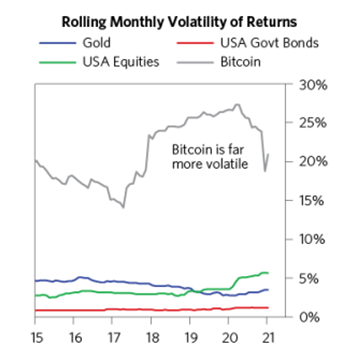

A well-worn critique of cryptocurrencies by the bears is that they are unsuitable store of value. What do we mean by that? Well, broadly speaking, a store of value is an asset, currency or commodity that retains its purchasing power into the future. In other words, what you get for £5 now (two coffees, a pint, 10 chocolate bars etc.) will roughly be the same in a 1-2 years time (give or take 10p). By definition, the extreme price volatility of cryptocurrencies means that what you get for 1ETH or 1BTC changes rapidly (Fig. 1-2) and this makes them unable to appropriately hold value and function as a means of exchange.

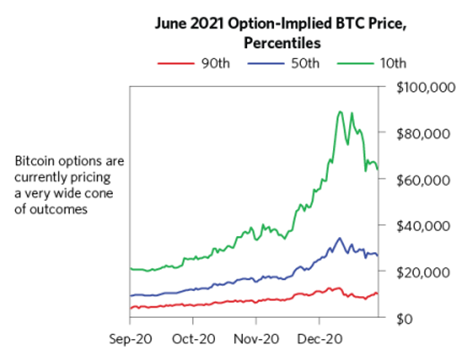

Taking Bitcoin as an example, its volatility far outstrips other investment assets (Fig 3.), and high open derivative interest suggests a large cone of expected future pricing outcomes (Fig 4).

Source: Bridgewater Associates

In such a context, participation in the crypto markets presents a challenge to large asset allocators such as pension and insurance funds, who must demonstrate asset liability matching (ALM) to regulators. Demonstrating ALM to regulators includes producing a cash flow projection of assets and an assessment of the relevant risks including interest rate, currency and inflation fluctuations. The extreme volatility of cryptocurrencies would make it almost impossible to produce an assessment that demonstrated the full materiality of those risks and sufficient ALM.

Similarly, mass adoption of cryptocurrencies in non-financial institutions is unlikely, given most vendors will not have sufficient cash to buffer the large, intraday price swings that have become characteristic of the asset class. From a fiduciary standpoint, it is conceivable that large treasury allocations to cryptocurrencies could be seen to breach a CFO’s duty to “act in the corporation’s best interests,” if price volatility materially affects a company’s ability to operate.

The price drops associated with Elon Musk’s tweets aren’t helpful when it comes to abating the fears of institutional investors, corporations, and regulators in this regard.

Pessimistic case #2 – Cryptocurrencies have no value in portfolio construction

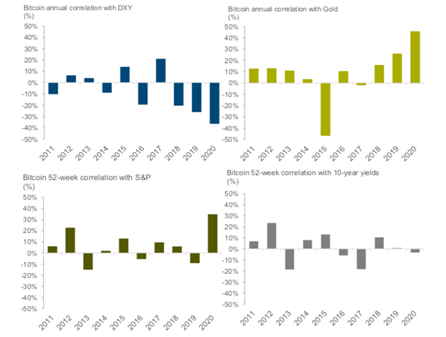

If cryptocurrencies are not a suitable means of storing and exchanging value, could they have a diversifying property in portfolio construction? For the bear camp, the correlation profile of cryptocurrencies means they can’t be used to construct well-hedged portfolios. A good hedge for an asset should display inverse correlation, and a ‘safe haven’ asset should be able to protect returns against adverse price and/ or inflation moves. Cryptocurrencies, on the other hand, demonstrate no correlation to traditional assets.

Analysis from JPMorgan (Fig. 5) shows that “there is no consistent message” which can be used to reliably create hedging strategies with cryptocurrencies. This contrasts with gold, the archetypal ‘safe haven’ asset, which has reliably supported 60/40 portfolio drawdowns since 1920 (Fig. 6). If there’s any value to cryptocurrencies in portfolio construction, it lies in their ‘wild card’ status.

Source: Bridgewater Associates

Pessimistic case #3 – Thin liquidity is unsuitable for institutional-sized trades

Whilst Bitcoin’s market cap has soared over the last 5 years, it remains a fraction of the market cap of gold (Fig. 7).

Source: Bridgewater Associates

Other investment classes similarly dwarf Bitcoin in terms of market cap and derivatives volume (Fig. 8). In order for large institutions to enter the cryptocurrency market, liquidity would need to support trades that are meaningful relative to fund size, without causing significant signalling or price impact. On the flip side, liquidity is unlikely to reach those levels without institutional participation and reallocation of capital to the cryptocurrency market. This chicken and egg problem has created a major roadblock for institutional participation.

Source: Bridgewater Associates

Pessimistic case #4 – Without clear regulatory guidance, institutions will not be able to enter the crypto market

Institutional investors need regulatory assurances around cryptocurrencies to increase their exposure. For the time being, most regulators remain unclear about their expectations for audit, client advice and financial protection, which makes it difficult for institutions to formulate best-practices and mitigate the risk of regulatory fines later down the line.

What’s more, there is a perceived conflict between central banks and cryptocurrencies, which has pushed some institutions to question the long-term existence of cryptocurrencies. The primary function of a central bank is to control the supply and demand of monies. As a competing form of tender, cryptocurrencies threaten the monopolistic position of central banks, and therefore undermine their ability to fulfil this function. As such, a total ban on cryptocurrencies from regulators and governments, although complex in practice, is not totally out of the question. Whilst efforts from the RBI to ban and restrict Bitcoin have been ineffective thus far, examples of such an existential risk materialising in public policy will make institutional investors cautious about entering this asset class in the absence of clearer, and more favourable, regulation. As Vanguard remarked: ‘if central banks create their own digital legal tender – wouldn’t you rather have that in your digital wallet’?

Pessimistic case #5 – ESG concerns

Even if institutions able to square crypto’s volatility, correlation profile and liquidity, they will also have to navigate a hairy ESG landscape to green-light investment. First off, there are significant concerns that cryptocurrencies are a vehicle for money-laundering and financial crime. The technology that underpins cryptocurrency transactions increases the anonymity of its users and this makes transaction monitoring, by design, more complex. New data indicates the problem is getting worse, with around $2.8bn laundered in crypto exchanges in 2019, up from around $1bn in 2018 (Chainalysis). Already subject to large fines for failing to comply with KYC and AML regulation (totalling an estimated at £2.6bn in 2020 alone), financial institutions don’t want to enter the crypto market without greater clarity from regulators on procedural expectations.

It’s also worth noting that most cryptocurrencies have a decentralised governance structure. This means that, in most cases, they are not tied to a single legal entity which can be held liable for damages should systems fail. Again, the inability to obtain protections and assurances from a central, legal entity represents a material risk for financial institutions, and makes large scale participation unlikely in the near-term.

Source: Financial Times, Data Source: CBECI

Optimistic case #1 – Cryptocurrencies are a store of value

As above, one of the principal arguments against institutional adoption of cryptocurrencies is that they are an unsuitable and untenable store of wealth. Such a critique implicitly promotes fiat as a superior store of wealth and, therefore, a more appropriate form of transaction and investment.

Yet over the last 40 years, 26 countries have experienced hyperinflation (IMF). Even the dollar, long considered the most stable fiat currency, has lost 92% of its purchasing power over the last century (Statista). It’s worth noting that central bank monetary policy has a significant role to play in the devaluation of fiat currencies over time. Interest rate setting, quantitative easing and direct stimulus are among some of the policies employed by central banks to maintain acceptable inflation levels and toe the fine line between economic growth and stability.

Demonstrating the power of fiscal policymakers, global central banks pumped over $9 trillion into their national economies during the Covid-19 pandemic (IMF). Similarly, M2, the total liquid money supply in an economy, has grown by 4x between 2000-2020, with particular growth spikes associated with economic recessions. In such a context, cryptocurrency advocates champion a monetary system that is free from monetary policy that artificially engineers stability and, in doing so, leaves economies more, not less, vulnerable to economic crashes.

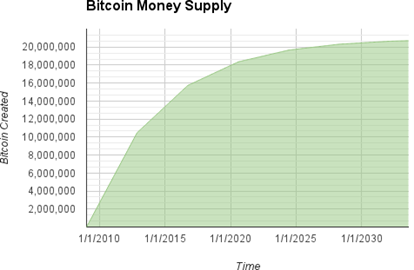

Crypto bulls also highlight that the supply of cryptocurrencies such as Bitcoin is not only scarce, but also finite (Bitcoin has a total limit of 21 million coins – Fig.10). This contrasts with physical stores of wealth, such as commodities, whose total supply is not precisely known and which, therefore, tends to fluctuate with demand and price.

Source: ‘Mastering Bitcoin’, A. Antonopoulos

Optimistic case #2 – A speculative and high-returning asset

The high volatility and correlation profile of Bitcoin and other non-stablecoin cryptocurrencies make it inappropriate as a protection or hedge asset. However, this is not the sole purpose of investment assets. The high risk-return profile of cryptocurrencies makes it a suitable speculative asset, with significant upside potential.

BTC and other cryptocurrencies offer both an increasingly attractive hedge against inflation, and an attractive returns opportunity in a tumbling yield environment (Fig. 11).

Source: Coindesk

This performance, which dwarfs that of traditional markets (Fig. 12), is set to grow. In a 10% allocation shift from gold to BTC, the price of BTC could reach $51,000, up to $85,000 in a 50% allocation shift scenario (Fig. 13).

Source: Bridgewater Associates

Optimistic case #3 – Indirect exposure signalling appetite

Many financial institutions have already gained indirect exposure to the crypto space. Fund and ETF investments have become a popular strategy for institutions to gain exposure to the asset class without incurring any regulatory or operational burden. Grayscale Bitcoin Trust (GBTC) has gained wide institutional investment, ranging from hedge funds such as Millennium, through to insurers such as State Mutual. Similarly, institutions have signalled an appetite for the asset class by investing in crypto mining and service companies.

In December 2020, Massachusetts Mutual Life Insurance became one of the first funds to publicly pair investment into a crypto company with an investment into the underlying asset, investing $100M into BTC and, in the same month, acquiring a $5M equity stake in NYDIG. These are clear signals of institutional investor appetite in the crypto space which preempts a transition to direct investment.

Optimistic case #4 – Cryptocurrencies are critical to the future of Private Banking

Downward fee pressure and client-led demand has made private banks eager to enter the crypto space.

Recent consumer interest in cryptocurrencies has not escaped the high-net-worth segment and all private banks are seeing significant transfers out of accounts and into crypto exchanges. Crypto is a real AUM and value drain for private banks. In many cases, this has incentivised private banks to rapidly scale their crypto capabilities in order to offer clients investing services and retain client value.

Small private banks have been the early adopters here. With compressed fees and ageing client bases, these banks view crypto assets as a way of differentiating product offerings and rejuvenating their client base. One such private bank is Maerki Baumann. Just 5% of its client base is under 40, sparking a move in June 2020 to offer crypto investing products as a way to attract younger customers. Strategically speaking, offering crypto investing to high-net-worth client bases is becoming a serious competitive advantage.

Optimistic case #5 – Institutional adoption: future is now?

Unsurprisingly, positive price moves have accelerated the creation of crypto-focused funds. As early as 2019, the price of Bitcoin is correlated with crypto-fund launches (Fig. 14).

Source: PWC, Crypto Hedge Fund Report

When we talk about institutional crypto, we’re really talking about the long awaited participation of non-crypto-native funds in the crypto market. Recent data suggests this shift has already begun. According to Fidelity, 52% of financial institutions already invest in cryptocurrencies. What’s more, over 71% of institutional investors expect to buy or invest in digital assets in the future and of those, 90% expect crypto assets in their portfolio by 2026.

Optimistic case #6 – The modern treasury

The new global economy will be born from a new method of exchange which allows cheap, transparent and verifiable transactions across the world. For crypto bulls, blockchain will provide the rails on top of which this new global economy can be built.

In October 2020, Square purchased 4,709 bitcoins (at an aggregate purchase price of $50 million), totalling 1% of the company’s assets at the time. The company upheld cryptocurrency as “an instrument of economic empowerment” which, in dramatically lowering the cost of exchange, provides “a way for the world to participate in a global monetary system” (full statement here).

There are two important implications encapsulated by Square’s announcement. First, cryptocurrencies may become a standard payment method in the not-so-distant future. Secondly, as a CFO, why fuss with FX rates and cross border payments if you can accept cryptocurrencies anywhere in the world? If cryptocurrencies such as BTC and ETH become the ubiquitous currencies of the future, corporates may find them attractive not just from a returns perspective, but also from an operational standpoint.

Institutional crypto: What’s next?

As the debate continues, I expect a number of near-term developments.

Derivative exposure

Institutions are likely to first participate in the crypto space through derivative exposure, such as ETFs, ETPs and indices. This allows institutions to gain exposure to the crypto space without the need to tackle technical challenges associated with custody, and plug knowledge gaps needed for coin trading. The world’s largest market index providers, including MSCI, S&P, FTSE Russell and Solactive, have all created a crypto index product of some description in the last 12 months.

Segregated crypto pools

A number of projects are underway to create segregated pools of cryptocurrencies that could be traded by institutions. This would effectively allow banks and financial institutions to trade with each other, thereby reducing money-laundering and counterparty risks involved in OTC trades. A number of initiatives are also underway to improve confidentiality in DeFi trading, which could prove instrumental in allowing institutions to reduce slippage in ‘whale’ trades.

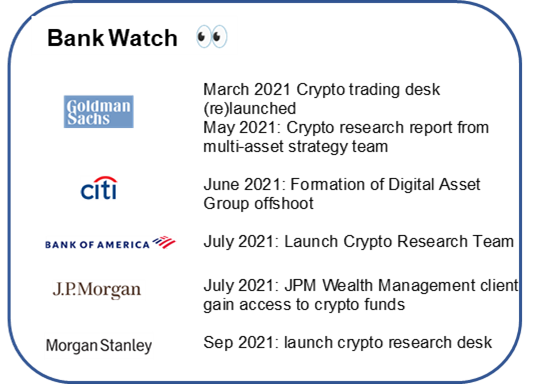

Research desks

Financial institutions will race to stand up research desks. Research desks are fundamental to designing investment strategies and servicing clients. As such, they are the first signal of an institution’s appetite to enter the space. JPM, Credit Suisse, and Goldman Sachs are among a few who have distributed informational packs for HNW and institutional clients in the last 12 months, whilst not providing any trading capabilities.

AML software

As the volume traded in cryptocurrencies increases, money will increasingly pass through crypto markets which will need to be verified and monitored. Whether financial institutions enter the crypto space or not, they will need to adopt new tools and procedures to protect themselves against financial crime and money laundering.

Closing Comments:

Ultimately, there is a huge prize for first-movers in the institutional crypto space. Retail investors have already initiated a powerful domino effect up the institutional chain, starting with private banks, hedge funds and now even insurers. As Ray Dalio puts it, “Bitcoin looks like a long-duration option on a highly unknown future that I could put an amount of money in that I wouldn’t mind losing about 80% of”. In a context where annual returns hover at 15% (18% with dividends) for US equities (S&P 500 2020), but 670% for bitcoin, it’s easy to see why even the most risk averse funds may be comfortable with allocating funds to a crypto ‘wild card’.

Bibliography

https://www.bankofengland.co.uk/prudential-regulation/key-initiatives/solvency-ii

https://www.bridgewater.com/research-and-insights/our-thoughts-on-bitcoin

http://www.fatf-gafi.org/media/fatf/documents/recommendations/Virtual-Assets-Red-Flag-Indicators.pdf

Personal opinions may change and should not be seen as advice or a recommendation. We do not offer investment or tax advice. Issued by Octopus Investments. Octopus Ventures is part of Octopus Investments Limited, which is authorised and regulated by the Financial Conduct Authority. Registered office: 33 Holborn, London, EC1N 2HT. Registered in England and Wales No. 03942880. Issued: October 2021.