Consumer happiness and business families

As a founder launching a startup in the consumer space, it’s easy to get fixated on product. After all, your new service or solution promises to change the lives of millions of new customers for the better.

Runaway success can happen, but for a proposition to reach those millions of satisfied users, a business needs a solid plan to scale. That means acquiring customers and making them happy.

But when it comes to securing investment, measuring success and scaleability in an early-stage startup is essential. Being across these metrics doesn’t just boost investor confidence: it also offers a roadmap for growth.

That’s why we’ve been working on a guide to the metrics that matter — how we should be approaching them, and what they can tell us about a business’s long-term prospects. All metrics, however, are not equal. Some will matter more – or less – depending on the kind of business in question. This is where we need to identify your business family.

Finding a business family

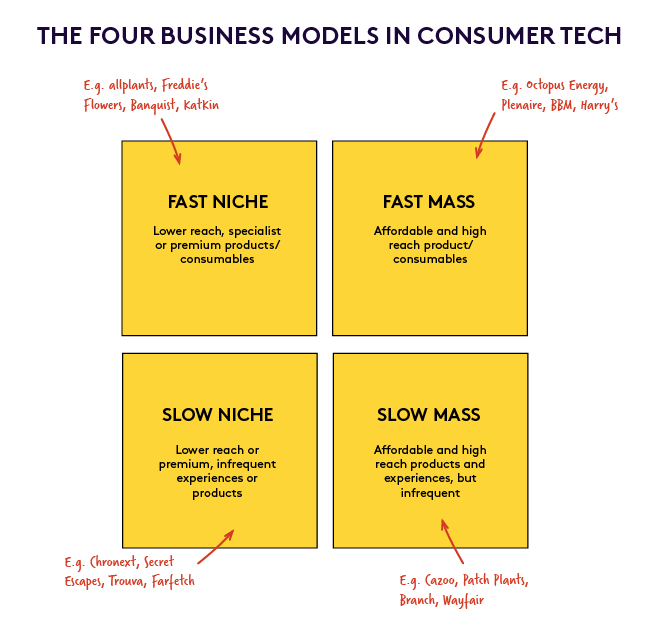

We’ve identified four broad models that we think resonate with the contemporary landscape in consumer tech. These are Fast, Slow, Mass market and Niche Market. A Fast business is one with an order frequency of once or more per month, while a Slow business has an order frequency of once per month or less. A Mass market business targets the whole mass market, where ~100% of consumers shop, while a Niche market business focusses on a sub-segment of the mass market — a specific consumer group, for example.

These broad groups combine to give us the four key categories in consumer tech: Fast Mass, Fast Niche, Slow Mass and Slow Niche. A Fast Mass business offers affordable products with a high reach, such as Octopus Energy. Customer happiness is critical to these businesses. The mass market brings with it more choice, and happy customers will be more likely to refer friends, driving organic growth through word of mouth.

A Fast Niche business, on the other hand, has a lower reach, and typically offers either specialist or premium products or consumables. A business in this category might look like Freddie’s Flowers, which regularly delivers flowers for home arrangement. Referability is very important in this space, where success lies in the ability to create a loyal community around a lifestyle brand.

Slow Niche describes businesses with a high order value, and low frequency of purchase. This category includes businesses such as Octopus Ventures portfolio company, Chronext, an online luxury watch marketplace. Slow Niche companies need loyal fans. Controlled scarcity can be used strategically here to generate hype around limited supply.

Finally, Slow Mass covers high reach products with low order frequency, such as Cazoo, another of Octopus Ventures’ portfolio companies. In these businesses, customer happiness can be measured through referability. Because loyalty takes longer than elsewhere to pay off for Slow Mass businesses, retention is less important.

Measuring happiness

Each of these business types places a different emphasis on the question of customer happiness. Successful brands don’t just deliver a satisfying product or service — they go a step further, and build a community of loyal customers.

It’s crucial to driving both retention and customer acquisition: on the one hand, a loyal community like this boosts life time value (LTV). On the other, it drives organic referral through word-of-mouth. But it can be hard to measure.

With investors looking for signs of customer happiness, and founders looking to confirm it, we developed the Octopus Ventures Customer Happiness Index. It takes in retention and referability, but also looks at upgrade ratios, churn, and perhaps the most important question: what percentage of users would be heartbroken if a company stopped existing?

The report

Establishing the kind of business you’re building, and finding a way to accurately measure both its successes and shortcomings, represent an essential step in building a world-changing business. It also makes conversations with potential investors easier, but it’s worth remembering there are no hard-and-fast rules. There are many factors that make up a pioneering consumer business. Performance metrics are important, but so is the team. A brilliant proposition is good — but a workable framework for growth to support it is even better.

If you’d like to read more about what we learned when deciding to investigate how, precisely, founders should go about measuring their businesses (and what, exactly, ‘good’ looks like), you can click here to read our new report. Measuring for Happiness: a consumer report on the metrics that matter.