Employee Healthcare Benefits in the US

What are the key components of US healthcare?

When you are creating a healthcare scheme for your US full-time employees, your company will have to decide on several key components and your starting point should be understanding the basic terminology.

An individual enrolled in a health insurance plan or policy is known as a beneficiary or member. The person who purchases the insurance is the subscriber and any other people on the policy (spouse or children) are dependents. The insurance company charges the subscriber a monthly fee called the premium. When a beneficiary receives health care services, the insurance company will pay the healthcare provider, clinic or hospital on behalf of the beneficiary. However, the beneficiary is still required to pay for some of the cost he or she incurs — this is known as cost sharing. Common terminology related to cost sharing includes:

- The deductible is a fixed-dollar annual amount of healthcare costs that the beneficiary must pay entirely out of pocket. For example, if the deductible is $500, the first $500 in medical costs incurred each year is paid by the beneficiary; for costs beyond $500 the insurance company may pay completely or require a co-payment or co-insurance;

- A co-payment (or “co-pay”) is a fixed dollar amount that the beneficiary must pay for certain services. For example, the policy might say that the beneficiary pays $15 out of pocket for each primary care visit and $25 for each specialist visit, while the insurance company pays the rest of the bill;

- Co-insurance is similar to co-payment but it’s a percentage of the bill rather than a fixed amount. For example, the beneficiary might pay 20 percent of the cost of a primary care visit and 25 percent of the cost of a specialist visit, and the insurance company will pay the remainder;

- The out-of-pocket max is the total amount that the beneficiary must pay in a given year. This includes what the beneficiary pays towards to the deductible, any co-pays, or co-insurance. After this amount has been reached, the insurer pays 100 percent of the costs for all covered services.

How best to create a budget for US healthcare costs?

If using a Professional Employer Organization, or PEO, an employer will typically allocate a set budget per employee per month. Each employee will then go online, activate their account, and elect how he or she wants to distribute the budget across the different categories of healthcare offered — and can even decide to increase the breadth and degree of healthcare cover (by contributing more to her plan) or indeed electing to reduce the cover either saving the company money or receiving the delta back in salary.

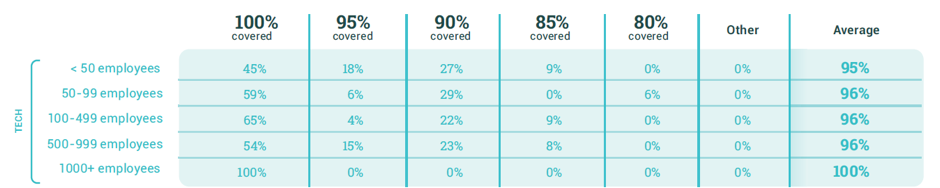

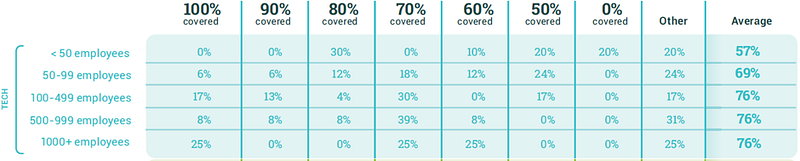

When it comes to forecasting healthcare costs, the simplest way to start is to budget a monthly contribution of $600-$800 per employee for Healthcare, $50 per employee per month for Dental, and $15 per employee per month for Vision. Sequoia’s research shows that over 95 percent of companies offer Vision and Dental care to employees if they offer a healthcare plan(Sequoia 2015). The table below sets out the range of employer contributions for employee health insurance by size of company and also distinguishing between employees and dependents.

For employees:

For dependents:

How does a company actually arrange and deliver a healthcare plan?

There are two main ways to organise healthcare in the US. The Company can instruct an insurance broker who will work with the company to tailor the appropriate package through a specific healthcare provider (e.g. Blue Shield) or the Company can use a Professional Employer Organization (a PEO) to offer a range of policies to the employees, often delivered on an online platform. From our review, it is clear that many fast growing smaller companies use a PEO, given the ease of set up and the flexibility a PEO can offer employees. See our separate blog on PEOs here.

According to various PEOs, the process of setting a healthcare scheme can take up to four weeks, from the point of the first call or email confirming interest.

If you are looking to move members of your team to the US for a Secondment and currently provide private health insurance in the UK, it is common that the employer would take out specific health insurance for the duration of the secondment. One-off short-term policies can be most simply managed directly with a health insurance broker.

For placements under a year in length, providers such as International Medical Group, can supply policies with an associated cost of $140–400 per month per employee. When looking at such options, it is worth understanding the full extent of the “deductible” and restrictions around pre-existing conditions. In most cases, relying on existing travel insurance is not sufficient and assigning an employee to an overseas geography for a fixed period is beyond the coverage of the policy.

Key questions and pitfalls to avoid

- What is the right level of coverage to offer to your team and their dependents?

- Do you want to include dental and visual plans as part of the package?

- What are the total employer contributions likely to be given the forecasted team size?

- How much control should the company have on policy selection as an employer or are the policies provided by the PEOs sufficient?

- It can take up to four weeks to go live with a healthcare provider. Make sure you take this into consideration with your go-live date and any operational scheduling.

- When assigning UK employees to the US for a secondment, what level of healthcare insurance will enable you to replicate the same experience under the NHS?

Where to go next

- Take a look at the resources in the Healthcare section of our US Dropbox

- Monster.com survey on relative importance of elements of a benefits package by employee background

- Additional dataset on the average contribution by employees and employers for healthcare

If you want to obtain specialist advice or more information on this topic, we would suggest speaking to:

We hope this blog has provided a useful introduction to this area of US benefits. As you might expect, the US market is dynamic and evolving all the time, so we encourage all companies to take specialist advice to determine what is the optimal blend of healthcare to fit their needs and circumstances. Have your experiences differed from the above? Comment with us, or alternatively email Will or Alliott directly.

Thanks to Mark & Jed at Sequoia Benefits, Gregory at Kranz Associates and Jon at Amplience for your help and guidance in pulling this blog together.