Sustainable Finance: trends and predictions for 2021

1. ESG: the hot investment strategy

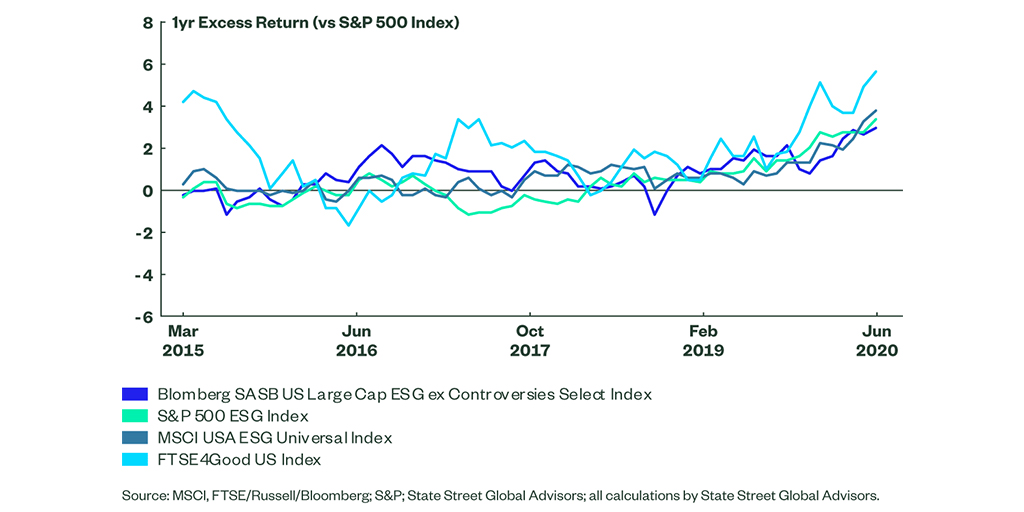

In 2020, ESG stocks displayed greater resilience to economic shocks, outperformance to conventional counterparties (Exhibit 1) and responded to investor concerns over climate change and social equity– all of which have been supercharged by Covid-19.

Exhibit 1: Rolling 1- Year Excess Return (vs S&P 500) of Top ESG Index Strategies (%)

This explains the record inflows to ESG funds which reached $1tr AUM in July 2020. In the US, one in 3 dollars invested, or $17 trillion AUM, is now managed under some sort of ESG or sustainability mandate – a 43% increase in just 2 years. This makes ESG the hot investment strategy of 2020 which is set to continue in 2021. If this current trend continues, half of all professionally managed assets in the US could be managed under an ESG mandate by 2025.

2. Sustainability data becomes the new Alt Data

Sustainability Data will be key in 2021. Despite the rise of ESG investing, ESG data is notoriously incomplete, inaccurate and static. Currently, investors and incumbent data providers frequently rely on data pulled from voluntary disclosure in annual reports. 2021 will see more financial institutions partnering with new ESG data providers that use tech to plug data gaps, form independent scoring methods and build out new datasets to help investors find ESG ‘alpha’.

3. Corporate reporting steps up

Increasing pressure from shareholders, clients and new regulation such as the FCA’s TFCD will require financial institutions and corporates to report on sustainability. In 2021, corporates and financial institutions that have not already built solutions in-house will need to buy tools to track, measure and reduce their environmental impact as well as fulfil a range of social equity and diversity targets.

Startups that seamlessly integrate into existing IT systems to draw sustainability data will be invaluable in the next year to help corporates fulfil reporting obligations. However, those that can break down this data and provide actionable insights for corporates will likely be the most sought after in 2021.

4. The rise of Green Retail Banking

2021 will be the year of Green Retail Banking. According to new research, moving investments and pensions to a sustainable fund can be up to 27 times more effective than veganism and flying combined for fighting climate change. New green neobanks and investment vehicles that target climate conscious and digital savvy consumers will grow in strength as consumers seek new ways for their money to match their values. I also predict conventional players will partner with carbon counting startups (Minimum, Cogo, Doconomy) to provide everyday climate data to their customers.

5. Investments to plug resource gaps

This year, the big financial data providers all threw their hat in the ESG ring. A healthy number of M&A and investment deals in 2020 shows the growing demand from investors to understand the impact and ESG performance of their portfolios.

| Top ESG Acquisitions 2020 |

| Truvalue Labs (FactSet) Sustainalytics (Morningstar) OneReport (Nasdaq) Risk Horizon (Landmark Information Group) |

| Top ESG Strategic Investments 2020 |

| Clarity AI : Deutsche Borse led a $15M Venture Round (Oct 20) Matter: NASDAQ led a Series A round (undisclosed $) (Dec 20) |

Such activity is symptomatic of a changing attitude in favour of buying to plug resource gaps rather than building solutions in-house. For early-stage investors, such activity paves the way for further exciting opportunities as the space matures.