Introducing the Salary Efficiency Ratio

I love a good ratio, and fortunately in the world of Software-as-a-Service (SaaS) companies, we’ve got loads of them. Annual Recurring Revenue (ARR), LTV/CAC, Rule 40, The Magic Number – you name it, it’s got a ratio.

With the exception of one, critical piece. I’ve been dreaming of a ratio that can tell me at a glance whether a company is spending too much money on its most important (and often most expensive) asset – its people. Alas, one has so far failed to materialise (as I’ll explain later, ARR per employee doesn’t cut it), which is why I’ve come up with it myself. Introducing the Salary Efficiency Ratio (SER).

While this measure is important for a host of reasons, there’s one that stands out. People are the hardest and most emotional part of a business to change, which is why growth through talent acquisition needs to be undertaken with the utmost responsibility – and much care should be taken to ensure it doesn’t get out of hand.

Anyone who’s had to reduce a workforce (which is basically every tech company over the past three years) knows the damage it does, both to the company and the individuals affected. No one wants to do it, which is why it’s a decision that often gets made too late – and rarely goes deep enough. In an ideal world, it wouldn’t happen at all, which is why engaging with your SER matters. If you don’t measure it for you, measure it for your employees!

How to calculate the SER

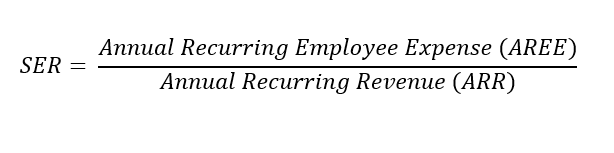

I’ve designed the SER specifically to measure workforce efficiency, looking at the total Annual Recurring Employee Expense (AREE – monthly employee compensation multiplied by 12), divided by a company’s Annual Recurring Revenue (ARR – monthly subscription revenues multiplied by 12).

In short, it offers a quick and simple ratio of total workforce compensation compared against ARR.

The SER for a SaaS company is calculated as so:

The AREE includes all expenses related to a company’s employee compensation, from salaries and bonuses to benefits. If you have a strategy for outsourcing employee activities, and this forms a large part of the staffing model, that should also be included (although genuine one-offs can be ignored).

As with ARR, AREE is calculated by multiplying the company’s monthly employee compensation expenses by 12 to get an annual figure. For example, a SaaS company spending £500,000 per month on employee compensation would have an AREE of £6 million.

Why ARR per employee isn’t enough

‘But what about ARR per employee to gauge employee efficiency,’ I hear people shout. Well, this metric on its own isn’t sufficient. ARR per employee only provides a snapshot of how much revenue is being generated by each staff member, without accounting for the cost of those employees. It tells you how much revenue is tied to each worker but doesn’t reveal how much you’re spending to achieve that revenue.

At first glance, a company with a high ARR per employee might look efficient, but if the compensation costs are equally high it could still be struggling. ARR per employee can also yield imperfect results when it comes to different business models. SaaS businesses which have a naturally large outbound sales team will have a much lower average salary than a pure, enterprise sales team driven company. The enterprise sales company could look more capital efficient according to ARR per employee, while being much less efficient in practice.

What good and bad SER looks like

- Good SER (< 0.5) Under 0.5 could be considered efficient. At this range, the company is spending less than 50% of its ARR on employee compensation and appears to be balancing labour cost against revenue effectively. This is the benchmark for all established businesses

- Acceptable SER (0.5 to 0.8) More established scale-ups would be expected to sit at the lower end of this range, but in fast-growing tech companies the top end is acceptable. Still, it needs to be closely monitored to ensure it goes down – not up!

- Poor SER (>0.8): This range indicates a spend of more than 80% of ARR on employee salaries: way too much! Even in a fast-growing tech business you’d want that ratio to come down quickly. It’s an important, early indication that it’s time to put the brakes on hiring.

This is just indicative; there will, of course, be different ranges depending on the stage of the business. The earlier the stage you’re at, and the faster you’re growing, the higher the SER that can be tolerated. But to build an efficient business, that number must, eventually, come down. The SER provides a quick test to stop fast-growing tech companies overreaching.

Real-life examples

One of the nice things about SER is that we can usually get the rough data to measure how the top performing SaaS companies are doing. Here’s my analysis of Salesforce and Zoom.

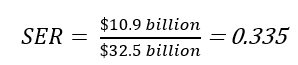

Salesforce1

- Annual Recurring Revenue (ARR): Salesforce reported an annual revenue of $34.86 billion in 2024, with subscription and support revenues making up 93% of this, putting ARR at around $32.54 billion.

- Number of Employees: Salesforce had 72,682 employees as of 2024.

- AREE: While exact salary data isn’t available, we can estimate. If we use an industry average salary estimate for tech employees (let’s assume $150,000/year), the total annual salary expense would be approximately $10.9 billion ($150,000 x 72,682).

This puts Salesforce’s SER at:

Unsurprisingly excellent for an established SaaS business like Salesforce.

Zoom2

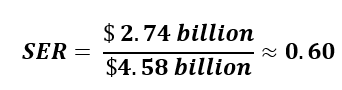

- Annual Recurring Revenue (ARR): Zoom’s reported revenue for the trailing 12 months ending July 2024 was about $4.58 billion.

- AREE: For fiscal year 2024, Zoom reported significant employee-related costs, including Selling, General & Administrative (SG&A) expenses of approximately $1.9 billion, and Research & Development (R&D) expenses around $814 million. These would make up a large part of the total salary costs.

If we approximate the total annual salary expense by combining SG&A and R&D, we get around $2.74 billion.

Using these figures:

As with Salesforce, these figures are estimates. On Salesforce we used a number of employees without knowing exactly what the average salary would be. Here we may have included some costs that weren’t staff expenses. But in both cases I think we’ll be pretty close.

It shows us that Zoom is a little bit higher than it might be for its stage, which could indicate that a recruitment pause may be timely.

Applying this methodology to other businesses, I found that Xero boasts an incredible 0.25, Shopify a solid 0.4 and Hubspot has a SER of around 0.54- acceptable, given that it’s in rapid growth mode.

Once again, I need to caveat all of these calculations by saying I’ve made huge estimates, in some cases on what the average salaries might be. In the case of Shopify, I included some of the business’s payments revenue but not all, given that payments revenue is lower margin than the SaaS elements. And of course, for AREE I’ve not used monthly cost x12 but year-end totals. Please use them as indicative illustrations rather than precise financial assessments.

Some of our own portfolio

I decided to run another test using our portfolio, where I knew the data would be accurate. For obvious reasons I’ve anonymised the businesses, but each have very different profiles.

| Growth | EBITDA* Margin | ARR | AREE | SER | |

| Company 1 | 18% | 10% | £6.9m | £4.9m | 0.71 |

| Company 2 | 143% | -137% | £3.2m | £3.2m | 1.00 |

At present, neither these companies are quite where we want them to be. But Company 1 is within the acceptable range and, as long as it doesn’t hire too aggressively, its SER will soon be firmly ‘Good’.

Looking at Company 2, we see some justification for its SER in its rate of growth, but it’s clear it needs to be reduced quickly: spending 100% of ARR on salaries is never going to work in the long run.

How to Improve the Salary Efficiency Ratio

If a SaaS company finds that its SER is too high, there are several strategies for improving it:

- Optimise workforce allocation: Ensure that teams are focused on high-impact areas that directly drive ARR growth, such as sales and customer success. This can help improve revenue without necessarily increasing headcount.

- Tie compensation to performance: Consider linking compensation to performance metrics like ARR growth, customer retention or new sales. This can motivate employees to focus on driving the business forward while maintaining cost efficiency.

- Enhanced focus on performance: Given SER’s direct relationship to employee efficiency, enhanced monitoring is one route to ensuring it doesn’t get out of hand. Keeping high performers motivated and managing lower performers out, or giving them the tools to improve, will keep your SER in check. But be sure to avoid the temptation to paper over poor performance by leaving underperforming staff in place and hiring an extra person to pick up the slack.

The last five years has held a number of hard-earned lessons, but key amongst them is this: if you let your headcount get out of control, you’re going to burn a lot of money very quickly, and it becomes very hard to slow things down.

We’ve got metrics for marketing and sales efficiency, for overall burn and for retention, but none of these ratios shine a direct light on headcount in an organisation. It’s a deeply unpleasant thing to reduce, with huge knock-on effects that extend beyond the individual affected to the company and morale. Letting headcount run away with itself is poor management that creates serious pain-points in the longer term.

By keeping an eye on the SER, leadership can maintain a clear picture of the revenue generated by employees against their cost. In doing so, it offers a major puzzle piece in planning for sustainable – and responsible – growth, and safeguards against the difficult conversations that come with overhiring. If you want to show off your business’s incredible SER, or share a world-changing idea you think we should know about – get in touch. You can reach me on [email protected]

1 https://www.sec.gov/ix?doc=/Archives/edgar/data/1108524/000110852424000005/crm-20240131.htm

2 https://www.globenewswire.com/en/news-release/2023/05/22/2673800/0/en/Zoom-Video-Communications-Reports-Financial-Results-for-the-First-Quarter-of-Fiscal-Year-2024.html

2 https://stockanalysis.com/stocks/zm/financials/

2 https://www.marketscreener.com/quote/stock/ZOOM-VIDEO-COMMUNICATIONS-57086220/news/Zoom-Video-Communications-2024-Annual-Report-46652408/