Climate FinTech: The startups helping banks to overcome the ESG resource gap

In order to finance a low carbon, equitable world, we need a more transparent financial system that accurately measures the impact of investments and creates brand new financial instruments. ESG investing has a huge role to play in driving this change.

ESG: What is it?

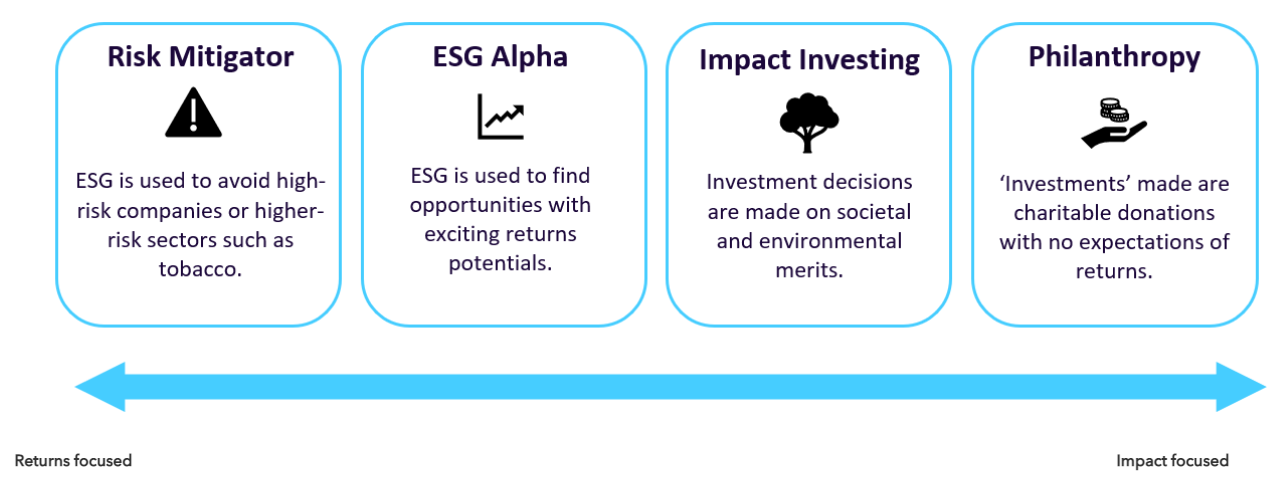

According to convention, investment decisions are made on risk and return factors. However, over the last few years, a growing number of investors are taking ‘environmental’, ‘social’ and ‘governance’ (ESG) metrics into consideration when making investments. In its most basic form, investors use ESG metrics to mitigate non-financial risks such as regulatory violations or exposure to harmful products. At the other end of the spectrum, investors base investments solely on positive ESG scoring such as investing in renewable energy or social development projects abroad.

Exhibit 1: The Sliding Scale of ESG Investing

Why Does it Matter?

Incorporating ESG metrics into investment decisions is no longer seen as ‘doing good’ but an important way to mitigate risks and outperform conventional assets. Research shows ESG stocks display greater resilience to economic shocks, are less volatile and frequently outperform their conventional counterparties.

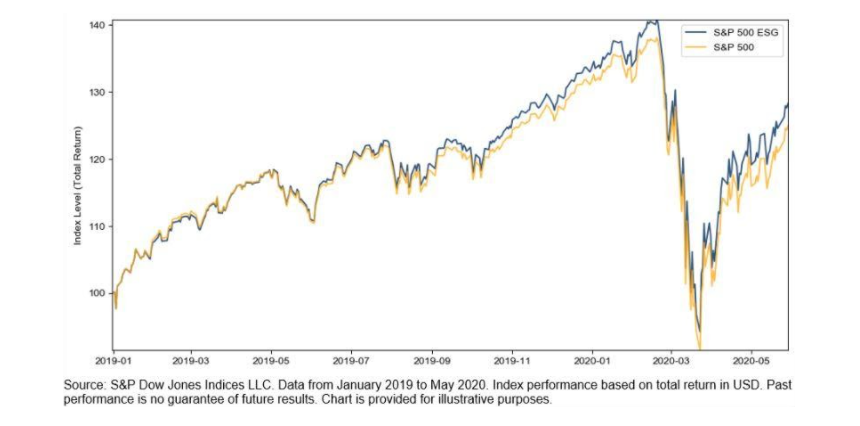

Exhibit 2: The S&P 500 ESG Index has outperformed S&P 500 by 2.21% since launch

In fact, 69% of ESG investors say investing according to ESG principles has helped manage volatility and downside risk. A further 56% of investors now cite ESG metrics as a way of generating outperformance. Covid-19 highlighted the importance of incorporating ESG principles into investment decisions. Socially responsible funds were more resilient during the pandemic, outperforming by up to 3% in Q2 2020.

This should hardly come as a surprise. Investments with higher ESG scores are associated with better employee engagement, controlled compensation, greater energy efficiency and less reliance on fossil fuels which typically have fluctuating fuel prices. Over time, these should translate into significant cost savings, engaged workforces and agile management.

ESG : A New Norm

The relative performance of ESG products during the pandemic was a major boost for ESG investing. In 2020, there were record inflows to ESG funds which reached $1tr AUM in July 2020. In the US, one in 3 dollars invested, or $17 trillion AUM, is now managed under some sort of ESG or sustainability mandate – a 43% increase in just two years. If such a trend continues, half of all professionally managed assets in the US will be invested under an ESG mandate by 2025.

Increasingly, ESG investing is looking like the new norm.

Exhibit 3: By 2025, half of all US assets could be invested under an ESG Mandate

Keeping Up With Demand

As investor appetite for ESG products grows and regulators ramp up pressure on ESG disclosure, financial institutions face several challenges to keep up with demand.

The biggest challenge is that a wide range of metrics fall under the ‘ESG’ umbrella and there is no standard to which corporates, investors or fund managers must adhere. As such, financial institutions must devise an ESG strategy and take a stance on environmental, social and governance standards where, in many cases, there is little internal expertise or resources to do so. According to a recent survey, only 30% of institutional investors have separate ESG investment teams to carry out this function.

To make matters worse, ESG data is notoriously inconsistent, incomplete and frequently reliant on corporate voluntary disclosure. So even when financial institutions settle on an ESG strategy, data may be missing or inadequate to fulfil it.

Finally, as more investors turn to ESG to generate ‘alpha’, it will become increasingly difficult to find differentiated strategies and data sources. Already, many stocks and financial assets trade at an ‘ESG’ premium.

Fintechs: Overcoming the Resource Gap

Financial institutions and corporates will need to partner with new tech players to plug internal resource gaps, scale their ESG capabilities and communicate with stakeholders effectively. There is also an exciting opportunity for new fintechs to capture consumer demand for sustainable investment products that are currently underserved by traditional players.

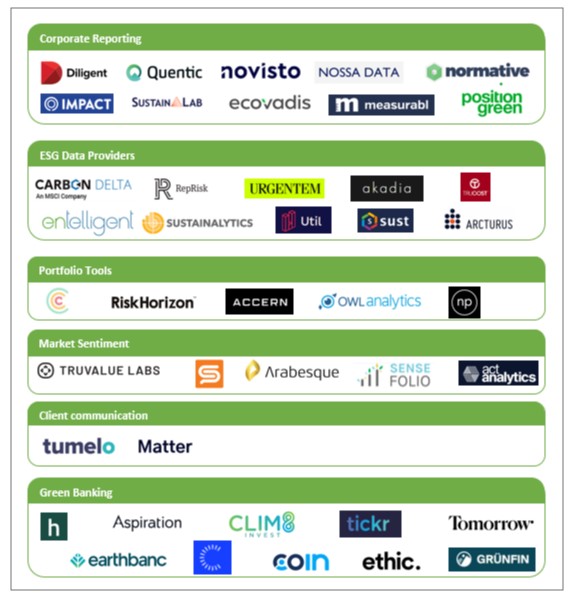

Market map

Corporate Reporting

The first stop on the ESG value chain is corporate reporting. Corporates are under increasing pressure from regulators, shareholders and customers to report ESG data and create strategic sustainability objectives.

Specialised tech tools can be used to automate workflows (Quentic) and extract data from existing IT systems (Normative, Novisto) to provide granular sustainability data at a fraction of the time and labour costs. New ESG audit tools (Position Green, Measurabl, Nossa Data) can also help corporates compile gathered data to produce shareholder reporting and meet regulatory requirements.

ESG Data Providers

New third party data providers that use tech to plug data gaps and build out new datasets can help investors find ESG ‘alpha’. For example, dynamic and alternative ESG data sets can help Portfolio and Investment Managers create differentiated ESG strategies (Akadia) and respond to the more climate conscious investors (Urgentem). Moreover, sophisticated portfolio screening tools (Util, Clairty AI, Accern) that can screen financial assets and portfolios by ESG metrics, thresholds and themes could provide a vital ‘plug and play’ solution for investment teams to quickly scale ESG product offerings and respond to investor demand.

Established players in this space (MSCI, Trucost and Sustainalytics) historically pulled data from corporate reporting and created scoring mechanisms that could be ingested by investment teams. Healthy M&A activity has ensured their ESG product offering has continued to expand with changing investor expectations and will remain important players – if not target acquirers – in this space.

Market Sentiment Tools

Market sentiment tools aggregate thousands of data and news sources to spot changing ESG signals in the market (Act Analytics, Arabseque, Sentifi). In real-time, these flag ‘ESG’ events to investors that could produce significant price changes to assets or even require removal from ESG portfolios. For example, the Boohoo slave labour scandal in July resulted in a 44% drop in shareprice in a week and highlights the important role such tools can play in keeping track of portfolio company performance outside of reporting periods. These tools can also offer a more proactive approach by providing insights into long-term risks and sustainability momentum for listed companies and sectors.

Client Communication

Financial institutions who construct ESG portfolios and products must find new ways of engaging and communicating with sustainability-minded clients. Innovation in this space has significantly lagged behind other ESG product offerings. Matter hopes to address this by offering Portfolio Analysis and Impact Reporting tools which can help consumers understand their investments. Tumelo, on the other hand, empowers retail shareholders through its digital platform to have a positive impact on its investments by voting on corporate decision-making.

Digital Green Banking

Traditional players have been relatively ineffective in creating ESG products and communicating sustainability data to end-users. As such, there is a significant opportunity for fintechs to respond to consumer demand for sustainability-driven investment products. New digital players (Tickr, Clim8, Cooler Future, Earthbanc) allow customers to round up change, deposit funds and choose to invest in a range of ESG and sustainable portfolios. Green neobanks build on this demand to offer climate data on everyday transactions and invest customer savings in green investment vehicles (Aspiration, Tomorrow, Helios).

Future Opportunities in ESG Tech

Regulatory Push

There is a significant regulatory push to integrate ESG data into corporate reporting. The EU, for example, has created a framework to define what can be considered a ‘sustainable’ economic activity (the EU taxonomy) to stem greenwashing in the financial sector. In the UK, from the 1st January, all UK listed companies will have to state in their annual reports whether they have made climate-related disclosures (in line with TCFD) or provide an explanation if they have not done so. Other initiatives are underway in developed market economies (US, Hong Kong) and will provide a significant boost to the ESG sector.

Similarly, climate and ESG commitments will come under greater scrutiny. Already the UNPRI has begun the process of reviewing and delisting signatories that have not met their sustainability targets. I expect this sort of intervention by regulators to mount over the next 5 years in order to hold financial institutions to account for ESG claims and strengthen credibility in the product class.

Building Loyalty in Wealth Management

The retail investor is underserved by traditional wealth managers. This is reflected in diminishing customer loyalty to a single provider. Over the next 3 years, one third of investors plan to switch wealth managers. This is likely to benefit new fintechs who are more agile and cater to the evolving needs of consumers.

In order to compete, traditional financial institutions must find new ways of engaging with their client base, provide differentiated investment opportunities and develop tools to reach a younger, socially-conscious audience. Digitally-distributed sustainable investment products could help traditional wealth managers compete in the digital sphere, build invaluable client loyalty and reach new audiences.

Wealth Transfer:

Over the next 30 years, $30 trillion of wealth will transfer from baby boomers to their millennial children. This will not only accelerate demand for ESG products but equally raise expectations around sustainability. Financial services providers should expect to supply greater information and data on the environment and social impact of their portfolios to end-users. Similarly, expect the range of ‘sin’ stocks to widen from tobacco, gambling and coal to other segments such as fossil fuel providers, aviation, and fast fashion.

Conclusion: People, Planet and Profits

Until a clear standard is developed by regulators and policymakers, there will be no ‘one size fits all’ approach to ESG investing. There is an exciting opportunity for financial service providers to create assets that advance people, the planet and profits and engage new audiences. Even for the conventional investor, the strong performance profiles of ESG-mandated funds and assets signposts the importance of taking ESG metrics into account to mitigate risks and generate good returns.

In order to keep up with the pace of growing investor appetite, financial institutions must take a proactive position on ESG investing and create new partnerships with fintechs, software players and alternative data providers or risk losing business to other ESG-adapted players.