Billing brilliantly: what to look for in billing software

Picture this: it’s a hectic Monday morning, probably the end of a quarter, and you’re sifting through a mountain of spreadsheets. Last night, you pulled an all-nighter working on the manual billing and invoicing process for your recurring clients. Now, you’re desperately searching for that one, vital, missing invoice you’re certain you created at about 3am – or was it 4? You’ve lost track of how many times you’ve double-checked, but the invoice and mismatches are nowhere to be found. Sound familiar?

If you’re managing all of your customer relationships in Excel, spending countless hours at the end of the month or quarter stuck in repetitive, manual processes, missing invoices – then this blog is for you.

Recurrent billing and invoicing are critical to any business, but as companies scale the processes can also grow to be amongst the most challenging. When companies are in their early stages, small with a handful of clients, these monitoring, operational and reporting activities might be straightforwardly managed in Excel. But with growth, and the onboarding of a host of new clients, tracking revenue, reporting adequately and managing the overall recurring cycles effectively become far more complex and time-consuming tasks, highly susceptible to errors. SaaS companies are particularly vulnerable, as their business models tend to rely on receiving recurring payments from customers who purchase their products with a subscription.

For these businesses, a software solution can make a critical difference. The right one won’t just help to streamline the billing process. It will also automate invoicing, manage revenue more efficiently and offer real reporting insights to founders and investors alike. But as we in the start-up ecosystem know, a problem calls for a solution. And recurrent billing and revenue management has not been ignored by software development companies. With so many available, it can be hard to know where to look.

I wanted to learn more about what really matters in a billing software solution. What do SaaS businesses need, and where should they look for it? To get an idea of how companies are using the options out there, I reached out to some of the Octopus Ventures portfolio companies to find out more about their set-up – and how well it’s working for them. In this blog, I unpack the results of the survey and offer some of my own tips on the platforms that founders might find the most helpful, whatever the growth stage of their companies. But first, let’s outline some of the key features every SaaS business needs to consider when they’re weighing up their options.

What should I be looking for?

While the main operational needs a billing platform should solve are likely to be evident to most SaaS CEOs and CFOs, it’s always useful to have a robust checklist. Any platform solving for management and operations needs to address the following:

- General Subscription Management: Any platform worth its salt should allow the user to summarize and set all the operational possibilities needed for the management of customer relationships. The robust subscription management capabilities it offers should include managing multiple plans, tiered pricing, handling plan changes, cancellations and renewals.

- Customisable Pricing Models: There are many ways to bill within the world of SaaS. Same fee for everything? Different tiers? Charging based on users or usage? The software must offer flexible and customisable pricing models that respond to the unique needs of the company’s clients. This should include, at least, usage-based pricing, metered billing and volume discounts.

- Automated Invoicing: Managing invoices is straightforward for the first handful of clients, but how does it scale to 100 or 1,000 clients? While Excel tracking can work (in theory, at least), a good billing software solution will offer automated invoicing features capable of generating and sending invoices. Ideally, it will also integrate with accounting and customer relationship management (CRM) systems, so there’s no need to manually upload the invoices to an accounting platform. The invoices will also need to match the price tiers and other characteristics specified in the CRM.

- Payment Processing: No piece of software should be able to do everything, and there’s no reason to suggest that billing and revenue management software should come with its own payment platform built in. But it will need to integrate with different payment gateways and offer secure payment processing options, including credit cards, ACH and PayPal, among others.

- Revenue Management: Revenue management is an essential feature for SaaS companies, as it helps manage revenue recognition and handle complex subscription plans. The revenue management features the software provides should include handling deferred revenue, revenue recognition and revenue forecasting.

- Dunning management: Dunning refers to the process of companies communicating with customers for money or account receivable collection. It’s a classic problem for all companies that receive recurrent online transactions, since failed payments are a challenge when managing recurrent plans. The software should provide automated reminders to customers with failed payments and manage the dunning process to recover lost revenue and prevent churn.

- Analytics and reporting: From founders and finance to investors (including us VCs), everyone loves good reporting. A robust platform should provide detailed analytics and reporting for real-time insights into business performance, including revenue, customer retention and churn rate. It’s an invaluable feature that helps every stakeholder to understand business performance and make data-driven decisions.

One problem, many potential solutions

With a multitude of options on the market, I’ve done a little research and put together this overview of some of the main platforms, alongside the key features and associated costs. These are the ones we find most widely in use across the B2B Software Octopus Ventures portfolio.

Product information and prices shown in this table have been sourced from platform websites. This doesn’t include all module options and I’d recommend conducting your own research into each of these for more information.

As you can see, these platforms include most of the features mentioned previously, as well as nicely tiered plans to try to adapt to the needs of SaaS businesses. One trend worth noting: free plans while businesses build their first $500,000 or so of ARR. It’s a great way of giving start-ups an option – and hooking them into the system early.

Now, the reality.

As a growth investor, I’m in a fortunate position. Aside from the theoretical research, plus hours of demo-sessions exploring these platforms, I’ve been able to conduct a small survey of the actual thoughts and feelings of several SaaS companies. I started with our very own Octopus Ventures portfolio, approaching SaaS businesses in stages ranging from Seed to Series B.

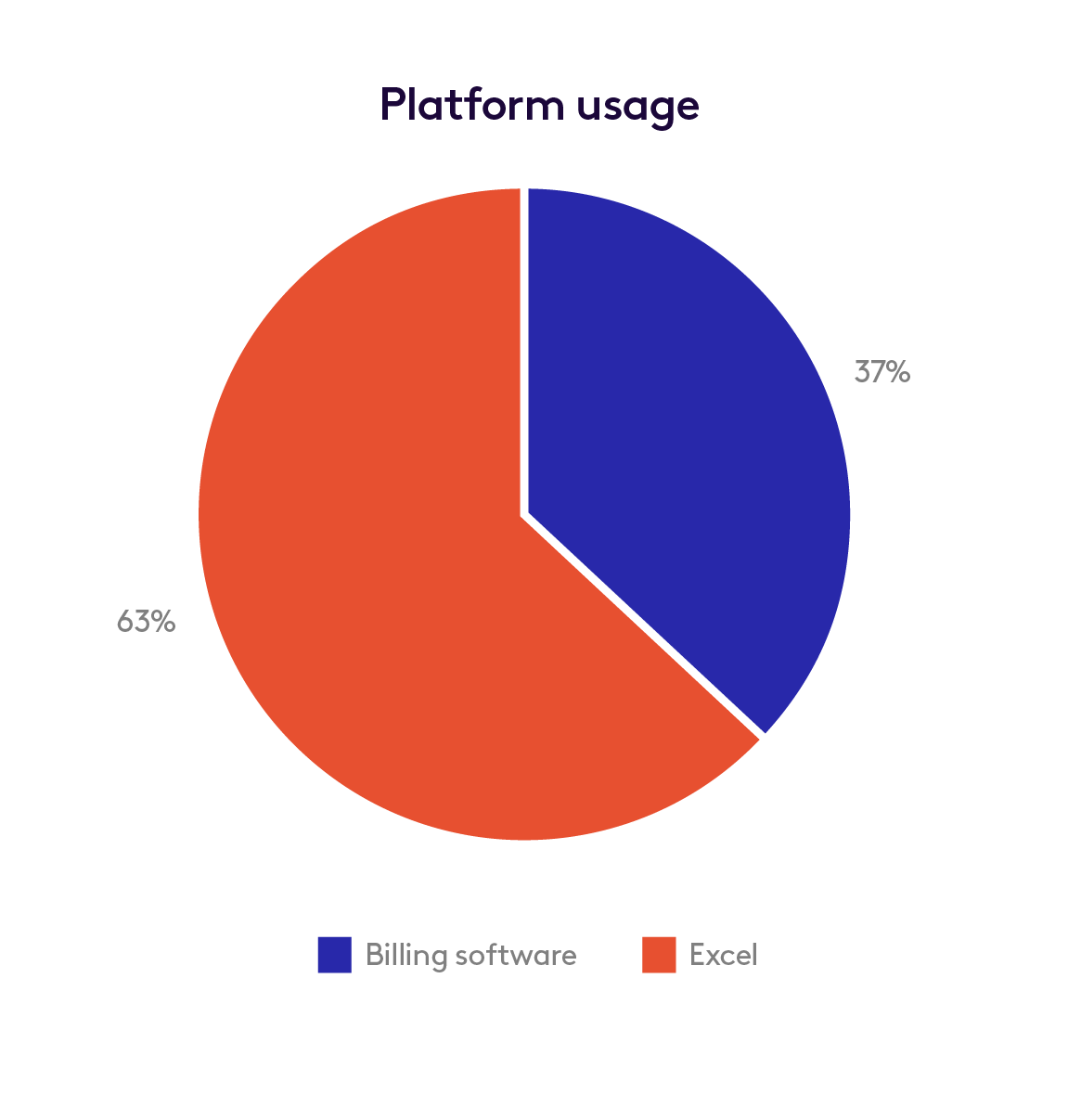

Believe it or not, the survey found that the majority are still using Excel to handle most of the tasks outlined above, with 63% of respondents, all broadly in the range of £1m-£20m ARR, still using Excel.

As part of the survey, we asked respondents how happy (or unhappy) they were with the way their chosen platform handled different aspects of the billing process, reflected in a score from one to five stars, where five is very satisfied. The questions related to general happiness with their setup, reporting, customer support, flexibility and initial implementation. Through the survey, we were also able to directly compare satisfaction levels amongst users of a dedicated software solution with Excel users.

Our portfolio companies expressed general satisfaction with the features offered by their billing and invoicing software, particularly in terms of automation and customisation. Common pain points emerged around integration with other systems, particularly accounting software. Other pain points included the complexity of pricing models and difficulty in setting up new plans/changing existing plans.

Excel users reported general dissatisfaction with reporting, customer support and implementation, in contrast to a relatively positive perception in these areas for billing systems. The flip side of this was high levels of satisfaction with Excel’s flexibility, which makes sense, given that Excel users have the facility to build systems that meet their own needs.

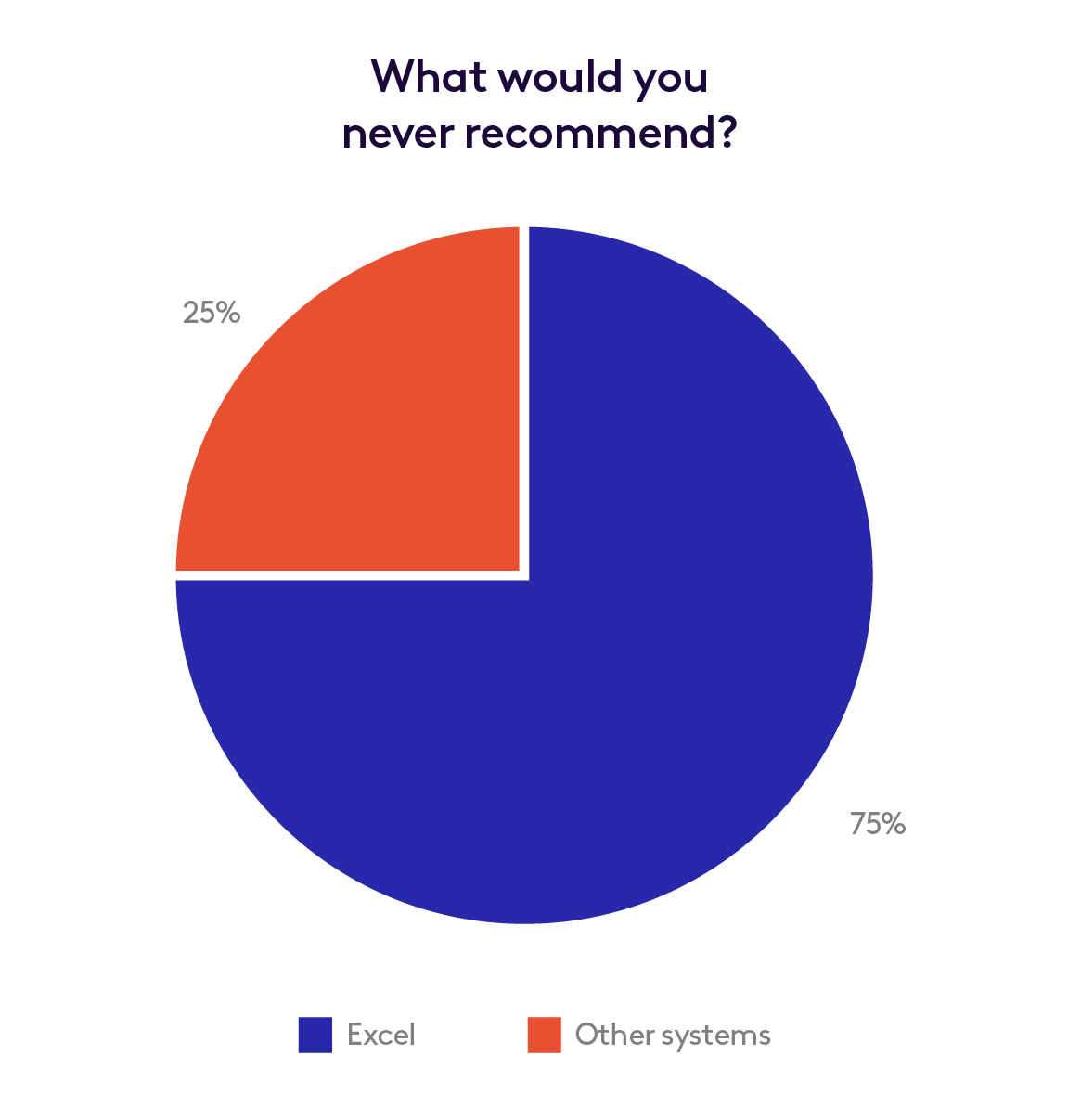

But when we asked our respondents which system they’d never recommend, Excel emerged as the least ideal option, with respondents citing the possibility of easy errors, excessive manual input and lack of scalability.

After all this… what could be a suitable setup?

Clearly, the answer to this depends on the unique demands of a given business. Still, in general terms, it makes sense to segment suitable platforms according to the size of the company using them.

We strongly recommend having a proper billing and invoicing system for managing your recurring revenues, processes, payments, and reporting. Although for companies in their early-stages this feels low-priority, establishing discipline early can be invaluable when it comes to scaling. Almost all solutions offer free plans for the first months or years, which makes picking a medium-sized platform and testing it out less of a commitment. With that said, here are some of the solutions we’ve seen useful for businesses at different stages of their growth journey:

For early-stage SaaS companies (From inception to c.£1 million ARR)

Excel: At the inception stages, Excel might be a suitable tool. With few customers and low complexity needed from the system, it might make sense to start with this as your main tool. Nonetheless, we strongly recommend companies shift to a proper software when possible so they can take advantage of all the benefits of a proper platform and its integrations and modules.

Billsby: Billsby is a decent, non-Excel option for smaller businesses because it offers an affordable, all-in-one solution for subscription billing. It comes with a user-friendly dashboard that simplifies the billing process and helps you manage your subscriptions efficiently. Billsby also integrates with popular payment gateways, including Stripe and PayPal.

For scale-up stage SaaS companies (up to £15m/£20m)

Maxio: Maxio provides a unified platform for SaaS billing and revenue management, offering subscription management, invoice customization, and revenue recognition features. Maxio also integrates with other tools such as Salesforce, Hubspot, and QuickBooks. The last few years have seen the platform acquire SaaS Optics and Chargify, which offered complementary strengths in terms of invoice management and reporting. As a result, Maxio can offer a fairly holistic solution to companies of a certain scale.

ChargeBee: this is another powerful subscription billing software designed for businesses of this size. Its features include advanced analytics, integrations with various payment gateways, reporting, and automated billing. With Essential, Mid-Tier, and custom Enterprise plans, this is another highly rated solution in the automated billing landscape.

For larger SaaS companies (beyond the £15m/£20m mark)

Maxio: As an enterprise-level billing software, with features outlined above, Maxio does have the ability to scale with businesses as they grow from small to large.

Paddle: is an all-in-one SaaS commerce platform that provides a powerful solution for managing subscription billing. It comes with built-in support for multiple payment methods, including credit cards, PayPal, and Apple Pay. Paddle also includes advanced features such as revenue recovery, fraud prevention, and tax management.

The final invoice

As I hope to have shown, picking the right billing and invoicing software for your SaaS business is important. Getting it wrong can make an already challenging process more painful than it needs to be, while getting it right can go a long way towards making it easier. While the insights gained from our own portfolio companies point away from using Excel, it can be extremely useful for businesses at the earliest stages of their journey.

Still, as your business grows, it’s important to look around and engage with different solutions designed to make your life easier. That scenario I described at the top will be all-too-familiar for founders of all shapes and sizes, and, it’s a distraction.

Using a service that takes the stress out of billing frees up time and capacity, giving founders the space they need to get on with what they do best: building businesses that will change the world.