Mind & Machine: What’s next for neural interfaces? Matt Vallin takes a deep-dive into the future of wearable therapies and brain-controlled computing

Introduction:

We have so much to learn about the brain. Identifying which neurons or groups of neurons correspond to a specific action, thought, process or disease pathway is incredibly difficult. Every week we come across fascinating developments. Just a few weeks ago, researchers at MIT published their work on uncovering the neurons that encode outcomes of actions, i.e. the neurons that appear to help with decision-making, and weighing the pros and cons1. Neuron-by-neuron, we’re starting to understand the complex networks and circuits responsible for healthy and diseased brain function.

The paradox of this complex organ trying to understand itself has only been fuel to the fire for researchers. Pioneers are harnessing the cutting-edge of technology to open up new possibilities in diagnostics and therapeutics, simultaneously advancing our understanding of the brain and our capacity to treat it.

In this deep dive we’ll explore advances in neural interfaces that are changing the way we treat disease and interact with technology. We’ll also take a look at some of the use-cases beyond health tech, to ask how our enhanced understanding of the brain, and ability to interact directly with it, will open up new frontiers in the consumer space.

But first, it’s important to clarify a couple of definitions:

- Brain-Computer Interfaces (BCIs), acquire brain signals, analyse them, and translate them into commands to other devices that carry out actions. These can be both invasive and non-invasive, but traditionally non-invasive devices are referred to as BCIs, and invasive BMIs (Brain-Machine Interface)

- Bioelectronic Medicine (BM) is a form of medical treatment which focuses on influencing the electrical signalling of the nervous system to deliver therapeutic benefits. Dysfunctional neural circuits can lead to dysfunctional organs. BM can restore these healthy patterns of electrical impulses. This can be carried out near, on the surface, or within the brain, and along the wider nervous system in the body.

We’re particularly excited about the convergence of the two domains above into device therapeutics and wearable therapies that can not only accurately read neural signals, but also influence them to better intercept, treat, and/or alleviate symptoms of disease.

In this deep-dive, we won’t look into drugs but instead focus on device therapeutics and wearable therapies which, we think, will define a new wave of treatments. Mobile devices are already delivering effective digital therapeutics, and we expect the next generation of consumer electronic devices (AirPods, for example), to do the same through bioelectronic medicine.

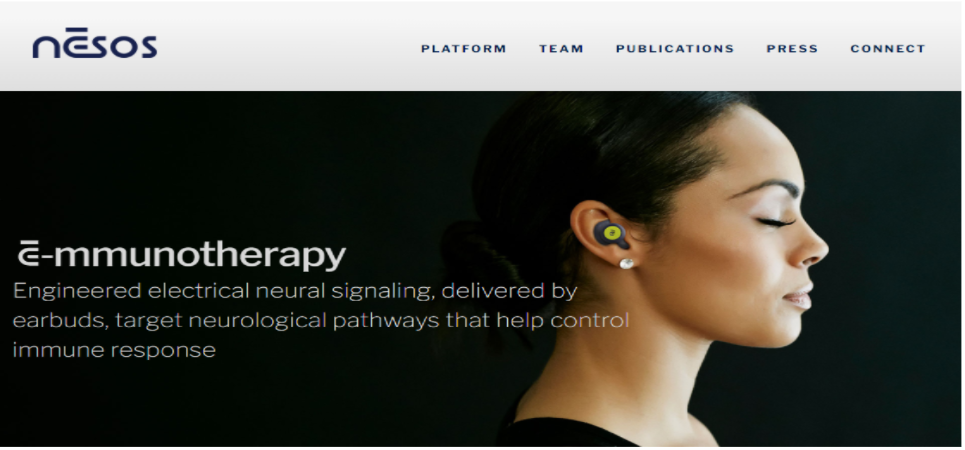

Pioneering companies such as Nesos are already on the case for auto-immune conditions. We’re also seeing specialised funds operating in the space, such as actionpotential.vc, which are generating even more momentum for wearable therapies.

Existing treatments for Parkinson’s, epilepsy and hearing loss, are already in market — and efficacious. The cochlear implant is a great example. But we anticipate that smaller, better, consumer-centric, and personalised therapeutic devices will emerge to cover mental health, neurodegenerative, neurovascular, cardiovascular, and auto-immune conditions.

Exciting clinical data, explored further below, cannot be ignored — and will form the basis for this wave of sensing and treatment.

Funding:

Europe is behind the US, but catching up, while the Bioelectronic Medicine market is growing incredibly fast.

Globally, the brain-computer interface market was valued at $1.4b in 2021 and is expected to reach $3.1b by 20273. The US market shows us that the BCI segment is set to grow. Currently, the US leads the way in BCI funding with roughly $300m in 2021, approximately 20 times more investment than in the UK4.

While acquisitions have been scarce, the ones we’ve seen have been meaningful. In 2019, Meta acquired CTRL-Labs for a sum reported to be near the $1bn mark. The acquisition highlighted a wider trend in Big Tech & MedTech: major companies are eyeing up the BCI space directly.

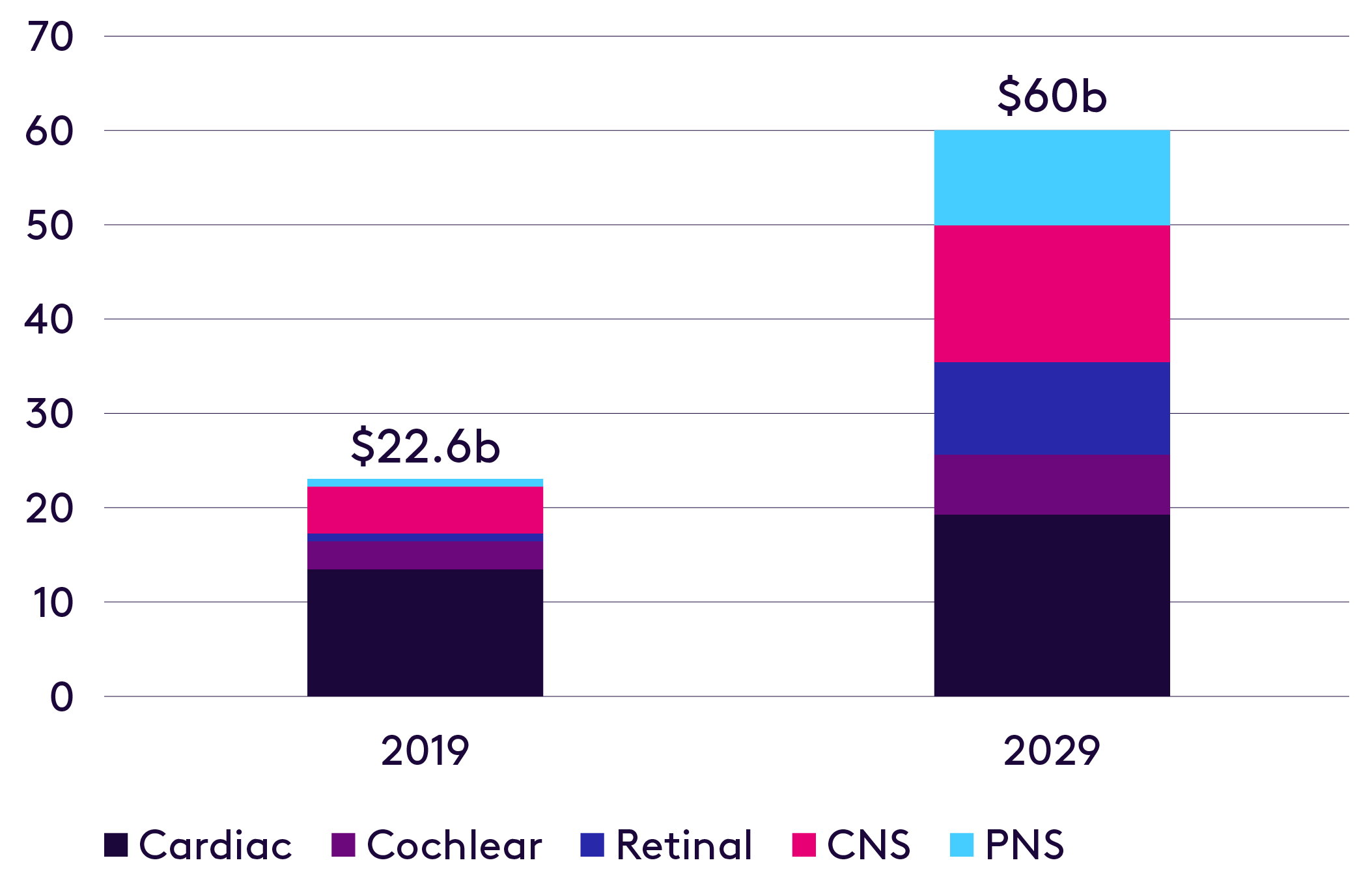

There’s also significant activity in the BM space. The market is set to grow significantly from $22.6b in 2019 to $60b in 2029, with the highest growth in specific sub-segments, including Vagus and Sacral nerve stimulation, which is expected to grow from around sub $500m today to near $10bn in 20295.

It’s important to note that medtech companies aren’t afraid to pay a high price for minimally invasive or invasive devices. From 2010 to 2019, implantable device technologies were associated with average biopharma M&A deal values reaching $5 billion2.

Bioelectronic Medicine Market Value, US$ Billions 2019-2029

In the UK, Octopus Ventures has proven its interest in the non-invasive space and we’re continuing to invest in exciting deep tech & healthtech companies. In 2020, we invested in CoMind, a company at the forefront of brain-computer interfaces. The company aims to fundamentally shift the way we as humans interact with technology and contribute to our understanding of the workings of the brain. We’re particularly excited by their non-invasive optical methods which have the potential to enable new biomarker discovery methods which could contribute enormously to our understanding – and treatment – of conditions ranging from neurovascular to neurodegenerative diseases.

Tech developments

What we’re excited about in hardware & wetware development:

The nascent potential of the BM and BCI markets outlined above is underwritten by extraordinary technological advancements in a few key areas:

- Improvement in hardware/wetware: neurovascular systems, new charging mechanisms, pioneering electrode design

- Distributed deployment models and miniaturization of devices

- New modalities beyond magnetic, electrical and traditional optical methods

We’re excited about the impact improvements in hardware and wetware will have on invasive and non-invasive devices. They stand to radically improve information transfer, as well as signal resolution, which means a higher signal accuracy in mapping both the location and timing of neuronal activity.

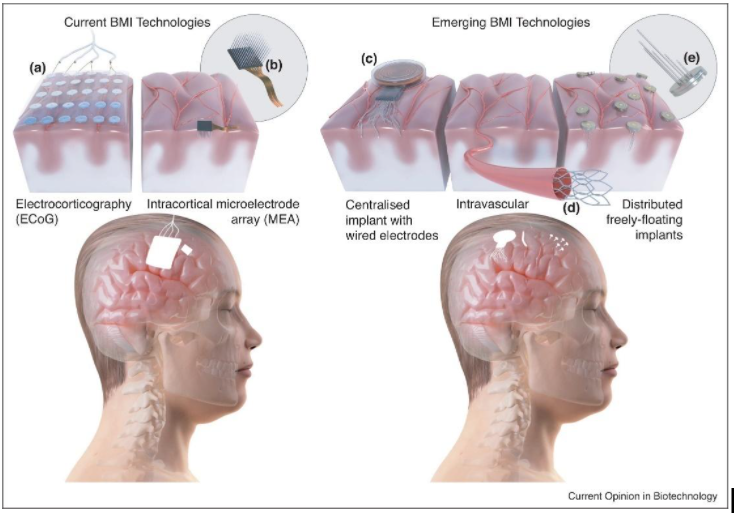

Some of the most exciting advances we’re seeing on the invasive end of BCI hardware are in neurovascular systems, which reach their target in the brain via blood vessels. Synchron, for example, has attracted serious investor interest. Fuelled by the likes of Khosla Ventures, the company recently obtained FDA approval for their first in-human study6.

While electrode bandwidth and channel count are constantly increasing, innovations in electrode design are driving new opportunities. From flexible or inflatable electrodes, to remote controlled ones, the expanded possibilities point to a potential reduction in the invasiveness of surgical implantation, and improvement in electrode positioning — without compromising on sensing and simulation accuracy.

At present, most device designs are centralised. Electrodes, for example, are packaged up together in one defined product. Distributed models promise vastly improved access to the target brain area. Neural dust and nanowires both offer new, and more effective, ways for electrodes to reach their targets in the brain — and a corresponding improvement in signal resolution. Devices are constantly being scaled down in a process of miniaturisation that now sees them measured in the nanometers. This is far more in line with the size of the brain tissue’s own cellular structure — and will also greatly enable higher signal accuracy7.

Charging mechanisms and battery life have long been a challenge in designing invasive, or minimally invasive devices. These problems are being engaged with directly, with some startups in the space using accelerometers to leverage the movement of the user to keep the device charged. This charging on-the-go means a longer lifespan for the implant. Others are developing ‘4D’ biodegradable devices, pioneered in the field of cardiology, which dissolve in the body over time. Amongst the advantages they offer are a reduction in the frequency of replacement procedures, and a potential improvement in the overall safety of devices.

New modalities beyond electrical, magnetic and traditional optical methods are being developed and tested in clinical trials. These include CoMind’s innovative optical methods, but also iontronic methods being developed by Panaxium. The business is using ultra-thin films of ion-conducting devices to both gather high-resolution data from cortical activity, and also activate neural pathways with less risk of thermal or electro-chemical damage to nearby brain tissue.

Where we’re excited in machine learning & signal processing to decode the brain:

Improvements in hardware and wetware are nothing without the signal processing & software to back it up and make sense of the noise emitted by the brain. Here’s what we’re keeping an eye on:

- Machine learning platforms emerging across research hubs

- Multi-modal neuroscience platforms making sense of brain data for pharma/medtech

- Hardware-agnostic brain data platforms

As our tools for imaging and mapping the brain have grown more sophisticated, researchers have been able to carve out a greater understanding of how it all works. At the same time, processing tools and machine learning have allowed us to make sense more of the data coming out of the brain. In practice, this is incredibly complicated; it doesn’t just demand technology capable of measuring brain signals accurately — it requires computing power and algorithms capable of decoding them. Now, machine learning and AI are reaching a stage where they can be used to decipher the noisy data emitted by the brain.

We’re keeping a close eye on the signal processing and machine learning research that’s getting closer to identifying which neurons, or group of neurons, are linked to a specific action, task, or process in the body. Researchers at EPFL in Lausanne, Switzerland, have developed a machine learning method to identify which neurons are responsible for a specific task. The researchers put the tech to work identifying the neurons responsible for the gait reacquisition process, but this technology can be used more widely across wider single-cell processes in the body9. While many different research groups are developing their own machine learning algorithms, it’s worth noting that the majority of them aren’t developed for commercial use — yet. Startups, however, are getting there.

Elsewhere, companies are focusing on aggregating brain data at scale to help power clinical trials and real-world studies, to enable the next generation of drugs and device from medtech and pharma firms, and to support payer adoption. Rune Labs is a pioneer in this space. Its platform leverages a range of data sources, including brain data (neuromodulation device data, EEG, brain imaging), patient and clinician-reported labels, and data from wearables. The company is using all this to build a digitised repository of human neuroscience that will fuel drug and device development in the next decade.

CereGate is developing a hardware-agnostic platform that transforms device data into personalised neural messages, and transmits them via implanted electrodes. What this means is that the AI platform can effectively ‘write’ a sense of balance, or touch, into a patient’s brain – which they refer to as ’mind-writing’. It goes without saying that when it comes to applying these platforms to real-world settings, security will be of paramount importance. Entrepreneurs will have to tread carefully to navigate the fine line between treating the brain — and manipulating it. Both ‘reading’ and ‘writing’ will also have to be efficient, to support high information transfer rates without being too energy intensive.

Additionally, as brain data becomes more accessible through in-ear EEG devices (companies like IDUN are paving the way but we expect next-gen ‘hearables’ from Apple, Nothing, and Humane to also play an important role here), the huge volume of brain data being harvested will give a new wave of startups the raw material to begin developing new applications.

A young startup from Imperial College is developing an EEG app-store of sorts, to enable developers to work on consumer-facing apps, such as thought-controlled passwords. Another promising hardware agnostic startup from Imperial College, called Cogitat, beat off stiff competition to win an international contest in deciphering motor intentions from EEG data. When it comes to commercialisation, the company has a bold vision for a thought-controlled metaverse environment.

Where we’re excited in the Clinical Trial and R&D space:

- Progress on Alzheimer’s Disease, Hypertension and Stroke

- Hyper-personalisation of treatments

- Targeting auto-immune conditions such as Rheumatoid Arthritis

In the US, Alzheimer’s and Parkinson’s cost some $200bn, equivalent to around 1% of US GDP, in care and lost productivity. Unless something is done to eradicate these diseases, the cost is estimated to increase to $1.1 trillion by 205012. However, the progress we saw in the neurodegenerative disease space last year was remarkable. Positive clinical data was reported, including by Cognito Therapeutics. Their non-invasive neuromodulation platform, to be used alongside visual and auditory stimulation for the improvement of memory, cognition, functional abilities and the reduction of brain atrophy in Alzheimer’s Disease, performed well in its Phase II trial10. We’re very excited to see further trial data as the studies continue. Their research is pioneering: a non-invasive wearable therapeutic to alleviate and/or reverse the debilitating symptoms of Alzheimer’s disease would rep-resent an extraordinary breakthrough.

Functional Neuromodulation, led by Prof. Andres Lozano, is among the enterprises pushing developments on the invasive side. They’re conducting a Phase III trial11 of their Deep Brain Stimulation (DBS) system, which targets the fornix, a major pathway in the brain’s memory circuit, shown to be one of the first areas of the brain affected by Alzheimer’s. The solution also obtained a Breakthrough Device Designation in mid 202111.

Alongside this, personalisation of treatment is becoming far more granular. Researchers at Stanford University have aligned the principles developed in brain stimulation therapies with MRI scans, allowing them to target their treatment to the neural circuitry of each individual. Results of the treatment, called Stanford Accelerated Intelligent Neuromodulation Therapy (SAINT) have shown highly promising remission rates in patients suffering from drug-resistant depression. In the UK, Bioinduction have developed a miniaturised cranial implanted closed-loop DBS device ~1/3rd of the size of existing systems, with sensing of patient movements and engaging circadian rhythms in order to better individualise patient treatment. Together with a simpler quicker procedure solution, the company is ultimately targeting refractory hypertension and post-stroke dementia — both large unmet disease areas addressable via neurostimulation.

The use of electrical stimulation to affect the body’s immune response has the potential to revolutionise treatment of auto-immune conditions, such as Rheumatoid Arthritis (RA). In 2021, Nēsos received FDA Breakthrough Device Designation for its vagus nerve digital therapeutic for Rheumatoid Arthritis12. While further clinical trials are needed to confirm the efficacy of treatment, vagus nerve stimulation could potentially extend to other indications: in-ear platforms that deliver treatment for migraines, or postpartum depression, are closer to reality than we might have thought.

What about the consumer side?

While we’ve seen strong growth from companies such as Flow Neuroscience, we remain wary of direct-to-consumer plays in the consumer health space over the next 3-5 years. Established pharma or medtech firms are less familiar with commercialising in the D2C space, and less comfortable with associated business models (like subscription-based neuromodulation). Because of this, it’s harder to conceive large acquisitions in the consumer health neurotechspace in the near future — but we’re likely to be proven wrong and always happy to be challenged.

With that said, the employee focus and productivity use-case is gaining momentum. Using over-ear EEG devices (like Neurable) or in-ear EEG signals (Idun) to help individuals to focus, be productive and, in turn, more satisfied in the workplace has benefits for both employees and employers. It’s also an attractive go-to-market for startups to pursue.

Future-facing employers will likely provide these productivity tools for their employees, but we’re likely to see the largest push for adoption coming from Big Tech, on both the hardware and software side. Apple is rolling out productivity tools, such as their recent Focus tool13, and Microsoft are looking for ways to reduce the amount of clicking and typing to get a computer to do what a user is thinking, without the use of a mouse or keyboard.

Startups are responding. The Neurable headphones, for example, can allow a user to change slides in PowerPoint — one of many thought-controlled micro-tasks (which, as a reformed consultant, is a source of disproportionate excitement for me). Elsewhere, BCI startups and research programs such as BrainGate are trying to win the Speller Test race, to realise the ambition of developing a BCI that can facilitate mind-controlled typing, while Meta seems to have given up on their programme14. This automation of micro-tasks, which can be coined as Neural Process Automation or Brain-Controlled Computing, will find wide adoption in desk-based professions, where small repetitive tasks add up.

Brain-controlled gaming or thought-controlled metaverse environments are a long way out, considering the challenge generating the right words (let alone simple sentences) from a user’s thoughts still represents. Still, helping players cut their reaction times by improving the speed of repetitive actions and tasks in gaming are likely to prove strong use-cases in the medium-term.

Conclusion

No one key breakthrough has impacted the space so much as incremental developments across a wide range of new technologies. From better wetware to better signal processing algorithms, a convergence of advancements across sectors have opened up a wealth of new possibilities in brain health.

It’s true that much about the brain remains a mystery – and AirPods as a bioelectronic medicine platform seem far-fetched – but with confidence building around what neural interfaces can do, consumers and clinicians are set to ride the wave.

At Octopus Ventures, we’re interested in applications that might currently be caught up in niches, with the potential to find a footing in bigger markets, and wider health applications. If anything you’ve read in this report chimes with you — and you have a brainwave of your own you want to share or discuss further, please get in touch. You can reach me on [email protected]

Sources

Source 1: https://www.nature.com/articles/s41467-022-28983-5

Source 1: https://www.evidera.com/digital-therapeutics-past-trends-and-future-prospects/

Source 2 : Nesos website

Source 3 : https://www.mordorintelligence.com/industry-reports/brain-computer-interface-market

Source 4 : Tacxn Data Analysis

Source 5 : https://bioelecmed.biomedcentral.com/articles/10.1186/s42234-020-0037-8

Source 7 : https://iopscience.iop.org/article/10.1088/2053-1591/abb857/pdf

Source 8 : https://www.sciencedirect.com/science/article/pii/S095816692100183X

Source 9 : https://www.nature.com/articles/s41587-020-0605-1

Source 10 : https://clinicaltrials.gov/ct2/show/NCT03556280; https://www.mobihealthnews.com/news/cognito-therapeutics-touts-positive-phase-2-results-device-delivered-alzheimers-treatment

Source 12 : https://www.builtwithbiology.com/read/nesos-receives-fda-breakthrough-device-designation-for-its-disease-modifying-digital-therapeutic-for-rheumatoid-arthritis

Source 13 : https://support.apple.com/en-gb/guide/iphone/iphd6288a67f/ios