Losing PMF Part Two: why do businesses lose PMF?

In the first instalment, I offered a definition for what, in my view, comprises PMF in a (specifically) venture-backed business. You can catch up with that blog here, but in short, PMF describes the sublime convergence of vision, customer engagement and scalability.

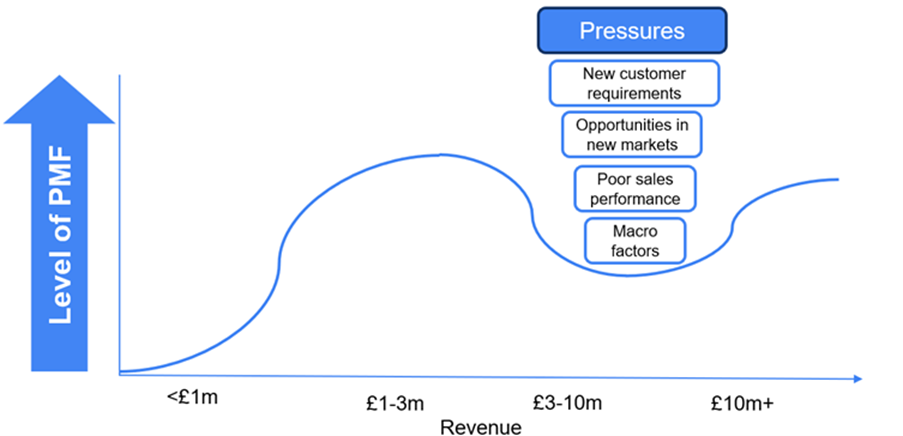

In this blog, I’m going to unpack the pressures that contribute to the destruction of PMF. Typically, they arrive as a company reaches £2-10m in revenues. The business is no longer flying under-the-radar; it’s small, but people know about you – and they have ideas about what you should become. But harder to navigate than unsolicited advice are the compelling opportunities…

Why do companies lose PMF?

The truth is, starting out, finding PMF really is half the fun. The search is the thrill: long conversations around the coffee table (or late into the night) asking what, exactly, customers will buy? What will the company be all about? And just how big will it get? It’s all problem solving and innovation, trying out new ideas to find just what works.

The beauty of this phase is that founder’s time (and maybe some angel’s capital) aside, it doesn’t cost all that much. The problems come later, when the PMF you’ve found has helped not only investors’ capital, but also a whole team of talented individuals who’ve bought into the vision you’re selling. Suddenly, a host of stakeholders are relying on you to survive.

Here are some of the pressures that put PMF in jeopardy:

Figure 3: The impact of pressures on PMF in scaling business

- Customer Requirements. It doesn’t take long for customers to go from wanting your product, to wanting you to build your product for them. If you could only build that new module, or integrate with this system, the cheque would be huge! Take a healthcare tech company, working off a Cloud based Software as a Service (SaaS) platform and selling to individual consultants. A large chain of private hospitals approaches. Owing to their security concerns, they want an on-premise solution with a few bespoke modules. Does the company take the contract? If it does, it isn’t just responsible for maintaining a SaaS solution – it also has an on-premises solution with extra, random modules to take care of. How does that look for scalability?

- Opportunities in new markets. When you’re small and successful the world is your oyster. Options for new markets and sectors multiply, but it is a good thing that all sorts of conversations are starting to drag you away from your focus. Here’s an illustration: imagine you’re a software platform focused on small healthcare providers. At a party you meet someone working for a large bank. They’re sure they can use a platform like yours in their sector, and they want to help and be part of your journey. It seems like an opportunity you have to explore – but how will it impact your vision of improving healthcare outcomes? How will you communicate it to the team? And, what does it say to your existing and prospective healthcare clients?

- Poor sales performance. At around £2-3m in revenue, businesses tend to move from founder-led sales to team-led sales. This is a critical period for reasons I’ve written at length about in other blogs. The resulting impact on revenues is often misdiagnosed as a product problem rather than a sales problem. Instead of engaging with funnel metrics, founders look to the product for answers, adding new modules, entering new markets and often destroying the vision in pursuit of the product ‘magic bullet’. But if growth was only being stifled by a poor go-to-market (GTM) strategy, new products will only exacerbate the issue. As sales messages get overly complex, customer engagement becomes next to impossible, leaving prospective customers unsure about what your product does or whether it’s for them.

- Macro factors. This comes last, because while it’s often the main thing founders blame for the loss of PMF, in my experience it’s the least likely to be responsible. Still, sometimes, it can be. It might be a competitor, launching a product that puts yours in the shade, or a paradigm-shifting new technology closing down a whole sector. But if macro factors like these are the reason you’re losing PMF, then you’re on a war footing (and that’s a whole new blog!).

What does losing PMF destroy?

Those are the pressures that can destroy PMF, but why is preserving it so important? Because if you don’t, you’ll find the following starts to get destroyed with it:

- Mission, Objectives, Strategy and Tactics (MOST): I’m a big fan of the acronym MOST. It’s a great way of reminding oneself that for a business to be successful, leadership first needs to understand what its long-term mission is, then define its objectives, and finally work on the strategy and tactics required to fulfil those objectives. Founders who get distracted by finessing tactics in the short term can find them eating the company’s mission and losing the ultimate vision for the company. Don’t let short-term tactics eat the mission! Let’s return to my earlier example: a healthcare software company being courted by a big bank. If the company does decide to service the bank, they also need to accept that their mission (improving healthcare outcomes) has lost relevance, and those looking at the business from the outside and the inside are likely to experience confusion over who, exactly, the business has been built to serve.

- Communication: When tactics drag you away from your core mission, everything inside and outside the business becomes confused. Sales activity starts to move to the centre of communication and leadership loses control of messaging. How are the product and technical teams meant to develop the product over the long term if they don’t know who they’re building it for? Should marketing maintain its focus on healthcare providers, or start promoting the average to large banks? With sales likely set up for product-led growth and low average contract values (ACV’s), is it time to get rid of the existing team and instead employ a band of enterprise salespeople with banking experience? When clarity on these points starts to unravel it becomes impossible for a founder to control communication throughout an organisation, especially if it’s growing rapidly.

- Gross Margin: Finally, and of particular relevance to software companies, the loss of PMF kills gross margin and scalability with it. Chances are, as a founder is dragged into new product requirements that don’t align with the original vision, they’ll also have to develop bespoke modules, place some new instances of the software in new geographies, or hire large customer service teams to maintain multiple ideal customer profiles (ICPs). Actions like this will smash your gross margin to bits and getting it back will be a painful struggle. Founder’s may claim that the new client is “profitable” but that never includes the cost of the distraction and opportunity cost of not focusing on the original mission.

Gloomy stuff, but as I’ll demonstrate in next week’s final instalment, it’s far from inevitable. It can be hard to recognise when your business’s PMF is at risk, but I’ll offer a few key indicators of what to look out for.

The purpose of these blogs has never been to scare anyone away from making the most out of new opportunities – next week I’ll explain how founders can do so without jeopardising PMF. We’ll also explore some strategies for growth when an existing market has been exhausted.

If you have any comments on your shifting relationship with PMF, think I’ve missed anything in these latest blogs, or want to tell me about a business you think I should know about – get in touch. You can reach me [email protected].