Losing Product-Market-Fit Part One: PMF in Venture Backed Businesses

First you seek it. Then you find it. Then you destroy it. And then – it destroys you.

Okay, I love a dramatic start. But when it comes to the relationship between scaleups and product-market fit (PMF), this is too often the story. Founders pour a lot into the search for PMF, but having found it they end up bamboozled by a world of new opportunities, or sidetracked by pressures mounting at every turn. Often, by the time their PMF is at risk, it’s too late – and the founder finds themselves up a certain malodorous creek without a paddle or any idea of how to row backwards.

In this series of blogs I’m going to unpack the basics of PMF, then take a look at the forces that destroy it. I’ll ask what steps founders can take to avoid sailing up our metaphorical creek in the first place, and for those who have I’m going to share my advice on winning PMF back. Before all that, though, it’s important to unpack the fundamentals of PMF and set it in a bit of context. While all businesses need to find PMF to survive, there are certain nuances that make it that bit harder for venture-backed businesses. So, with that said…

What is PMF anyway?

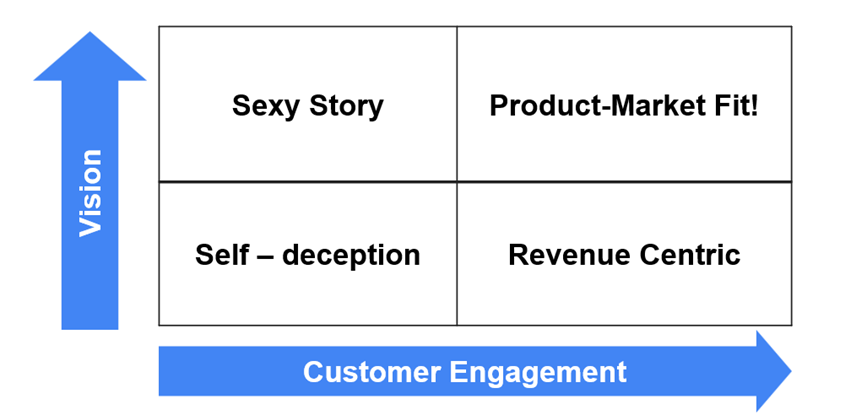

PMF is easily recognised in the wild but can be a challenging concept to explain. One of the most straightforward visualisations I’ve seen comes from Adam Fisher, at Bessemer. It’s what I always turn to when I’m introducing PMF.

Figure 1: The matrix of PMF (Adam Fisher, Bessemer Source: Venture Partners, 2019)

Adam unpacks his matrix in depth in his excellent blog (do read it when you’ve finished this one). PMF, he writes, ‘At once denotes successful product delivery, a working go-to-market strategy, and customer satisfaction’. He makes the case that to have PMF you need both a clear vision and customers to engage in that vision.

If you have neither, chances are your product is being developed by technicians because it’s interesting to them (like most of AI). If you have a strong vision, but little traction, then you’re just a sexy story (think flying cars). Businesses on the opposite corner, working to customers’ whims rather than their own vision, are more akin to consultants. But businesses with both vision and customer engagement locked-in might just have PMF.

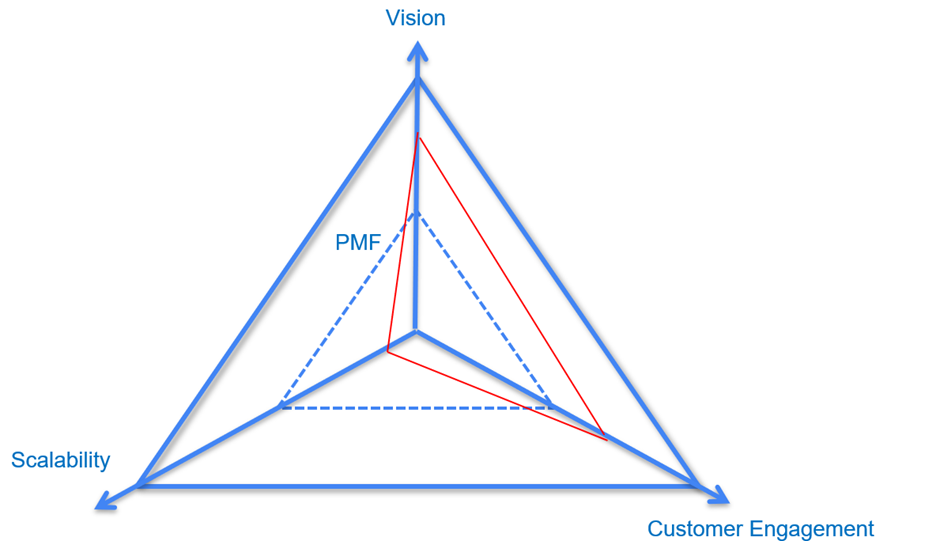

But for me, this isn’t the whole story. Venture-backed companies face a further challenging dimension: scalability.

Here’s what I mean. Imagine you’re a local artist, selling landscape paintings at craft fairs. It’s a nice business, with a clear vision – selling your paintings – and you have customers fully engaged. But (and this is a big but) there’s nowhere to grow. A cottage industry, producing and selling decorative paintings direct to consumers – for whom the personal touch of buying from the artist is surely part of the experience – has none of the scalability we’re looking for in venture backed businesses.

This third dimension is illustrated in the following chart.

Figure 2: PMF for venture-backed companies

Here, the dotted blue line denotes the minimum of each PMF element required across the three axes of vision, customer engagement and scalability for a business to meet venture expectations. My hypothetical artist is represented by the red line. To meet the requirements of venture backing, the red line would need to sit fully outside the blue line. Clearly, the artist doesn’t have a bad company. It even meets Adam’s definition of PMF. But scaling would demand a lot more craft fairs (as well as the production of far more paintings) than an individual could hope to attend. It is, therefore, unsuitable for ventures.

When considering how we lose PMF we need to keep all three PMF elements in mind. Often, it’s a founder’s desire to keep customer engagement growing that destroys the scalability and vision of the product.

Most of the articles you’ll read on PMF talk exclusively about finding it. But just because you’ve found it there are no laws that say you get to keep it. In my next blog, I’ll explore some of the pressures founders face which, as an investor, I see regularly impacting PMF. And if you have any reflections on PMF you’d like to share, or a business (with those three key elements in perfect place) you think I should know about – reach out. You can contact me on [email protected]