Our investment in Vitesse

Over the past nine months our Future of Money team has immersed itself in the world of cross border payments. Our conclusion (unsurprisingly) has been that the global settlement process remains ineffective and outdated. Funds can take several days to reach beneficiaries and the process is riddled with hidden intermediary charges. We have seen a tremendous amount of innovation in domestic payments resulting in near instant payment networks for most of Europe. Yet given the number of parties required to facilitate cross-border payments, it can still be just as fast to hop on a plane and hand over the cash as it is to send it over a cross-border payment network.

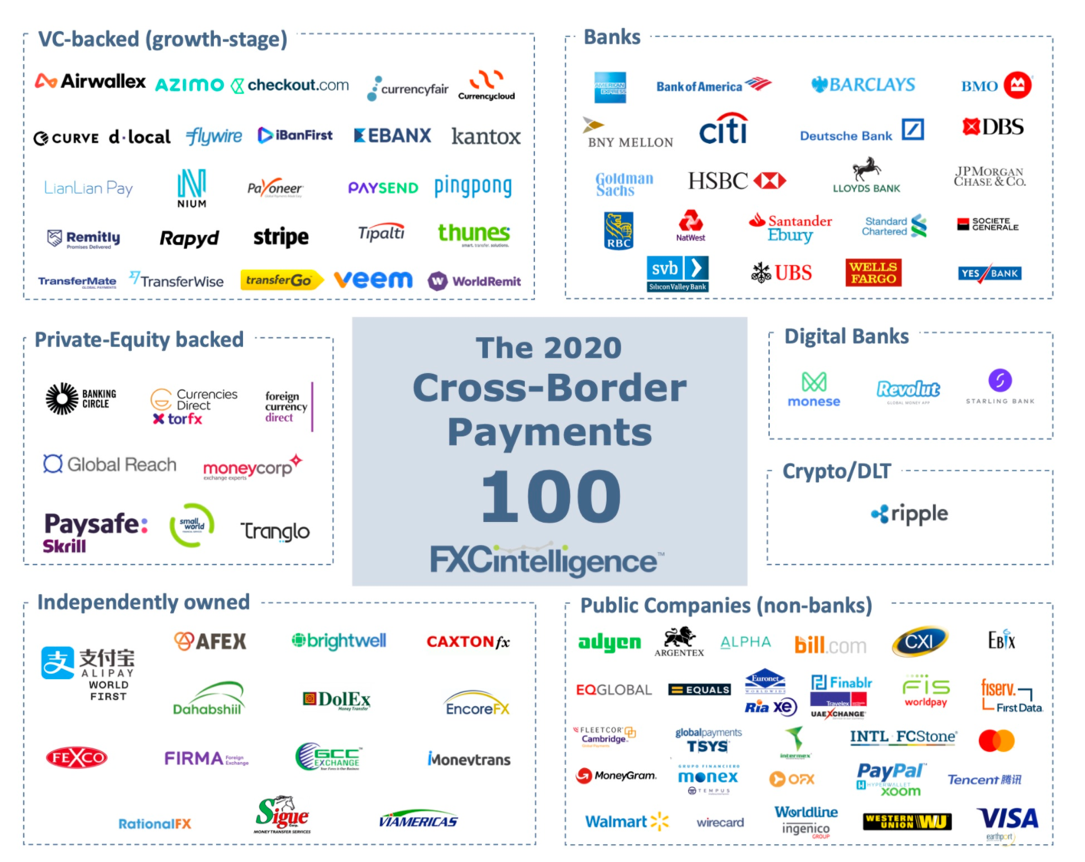

It didn’t take us long to form this conclusion, however. When you look at the market map below there is an exploding list of start-ups, particularly on the consumer side, tackling all the various sectors that require cross-border payments.

Incumbent banks still hold considerable market share in payments despite a customer experience and fee levels which leave a lot to be desired. To generate any alpha on an investment we needed to spot a market which had limited startup attention and was being poorly served by the incumbents.

With a good deal of luck and some accrued knowledge from our investments in the insurance space (Bought By Many, By Miles and Dead Happy), we were put in touch with an innovative payments company solving a big problem for global insurers. For the last five years Phil McGriskin, Paul Townsend and the rest of the Vitesse team have quietly built a market-leading global domestic settlement and liquidity management platform, spanning over 100 countries and 60 currencies with £2.3bn processed to date. They had also identified a greenfield opportunity – Insurance Loss Funds – essentially leveraging their tech-enabled global payment network to make the operation of these more efficient, transparent and controllable. For those who haven’t grown up reading about Insurance Loss Funds, they are simply large pools of money that managing general agents set aside for third party administrators to use to write business and pay out claims on their behalf. One managing general agent can have many third party administrators all across the world and as such face reconciliation challenges as well as requiring a corresponding payment network to affect the flow of payments in each of these countries.

Phil and Paul are payments veterans, having co-founded the payments company Envoy which was acquired by Worldpay, and the Insurance market dynamic was exactly the window they were looking for. Loss Fund accounts and claims settlement are currently being handled primarily by large banks that provide a slow and opaque payment network, often requiring insurers to over capitalise the Loss Funds, with very limited control and transparency. With the support of many of the Envoy team, Phil and Paul set about building Vitesse.

It seems like Vitesse is onto something. The team has contracted over 60% of the leading UK insurers, has processed over 2.4m transactions, and are increasingly seen as the go-to solution in this space.

For us at Octopus Ventures, the chance to back experienced founders building a business in a space which generates $2.2tn in global revenues each year was a no brainer. We are excited to be leading their series A, and are grateful that Phil, Paul and the rest of the team have invited us to join them on this exciting journey!