Share Option Schemes:

Why have option schemes?

At the beginning of the start-up journey there is probably limited cash in the bank. Yet founders want to attract best-in-class employees to propel the business into profitability. One of the solutions? Equity. It’s equity that gives start-ups the means to attract and retain talented employees away from the large, cash rich corporates. Equity takes two forms: (1) shares in the company; (2) options over shares in the company.

Issuing Shares

Where an employee is issued shares in the company, they become a shareholder immediately. The existing shareholder base is diluted accordingly.

Nil or partly paid shares: here the employee agrees to subscribe for shares at their current market value (which will need to be agreed with HMRC). There is also an agreement that the employee only pays the subscription price for those shares when it is asked to by the company. Typically, the company ‘calls’ for this payment immediately before it is acquired. Whilst there shouldn’t be any income tax arising on the acquisition of shares, since they are acquired at market value, there is a benefit in kind: the employee is essentially being loaned the subscription amount. This would be charged to the employee in the usual way.

Acquiring shares: here the employee agrees to subscribe and pay for shares at their current market value. (Again, this will need to be agreed with HMRC.) Notably, the employee would need to have the cash to actually proceed with the subscription. There will be an income tax charge to the employee if the shares are acquired for less than market value. The employee will generally enter into what is known as a ‘section 431 election’. This will allow them to crystallise any potential income tax at the point of acquiring the shares and ensures that all future growth in the value of the shares will be subject to capital gains tax only.

In both scenarios, the employee will enter into a subscription agreement and the founders and employees will need to enter into — or update — a shareholders’ agreement. This will govern their relationship with the company and set out what rights and control each party has over business matters.

Why might you like this approach?

Your employee is absolutely fundamental to the business, so of course you want them to feel properly incentivised. Knowing they can vote on shareholder matters, receive information on the business and eventually receive dividends makes them much more aligned for the long term. The business will benefit from the cash injection from the subscription monies to the extent they are paid upfront.

And the downsides?

Once shares are issued, it is very complicated to try and claw them back. Whatever the equity stake, it should be viewed as having been completely divested once issued to an employee. The employee shareholder now has some potential leverage in all matters which require 100% consent of shareholders. No buyer really wants to rely on drag provisions in order to force an acquisition. If the employee leaves, particularly if under acrimonious circumstances, agreeing a buy-back or a sale of their shares can be a long and difficult negotiation. Agreeing the valuation of privately held shares is often time-consuming and costly.

Granting Options

Where the employee is granted options in the company, the employee has the right to become a shareholder at some point in the future subject to the fulfilment of certain conditions. The shareholder base will not be diluted until those options are exercised. With EMI (Enterprise Management Incentive) options, if these are granted at market value, there is no income tax or national insurance contributions on their exercise.

There will be time and expense invested in establishing the share option scheme. This will involve setting up the scheme and its rules, as well as having the relevant employee(s) enter into an option agreement.

Why might you like this approach?

You want the employee to stay with the business for the long term but you also want the flexibility to govern your business without interference from shareholders exercising voting rights or extracting dividends or information from the business. Dealing with employees who leave can often be more straightforward if they are option-holders as opposed to shareholders as there is typically an in-built mechanic which governs whether options are retained in different circumstances.

And the downsides?

It takes time and money to set up a share option scheme and draw up individual option agreements. Employees may be sceptical about the real value of these options: it can take time to build up their stake and they may also be dependent on certain events happening such as exit, 4 years’ employment or revenue targets being met.

How big should the option pool be?

Generally there’s a correlation between the option pool size and the maturity of the business. Founders and VC investors will spend some time negotiating this, but a 20–25% option pool is not uncommon at early stage, 10–20% is more typical for bigger private businesses and a big listed plc may have only around 5%. Overlaying this are the particular needs of your business. Setting out a 2 to 3 year hiring schedule, considering up-coming promotions for existing employees and gaps for hires will help in identifying the quantum required as well as the shape of your option pool.

Dilution

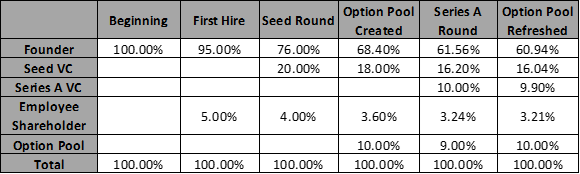

Options are granted over ordinary shares in the company, so this is the share class that will suffer the most dilution (that is, a reduction in the percentage of shares or options that you own as a result of more shares being issued). Dilution most typically comes from either new issues of shares to incoming VC investors and/or those which are made to refresh the size of the option pool. Highlighted below is the journey of both an employee shareholder and an option holder through two fundraising rounds, as well as the creation and top-up of an employee option pool. The table shows how new share issues affect their shareholding.

Compensation principles — time well spent

Our most successful CEOs invest a significant amount of time setting out their principles of remuneration. This is the most common area where start-ups fail to invest proper time, which can prove costly later on.

Useful questions to ask when creating a framework for your approach:

1. What do you want your company’s compensation culture to be? Which is most important: to be fair, to be consistent or to be competitive?

2. What’s your approach to attracting new hires?

3. What’s your approach to promotions and retaining talent?

4. How does this all relate to the base salary (and any bonus) that is paid?

For more detail on options and strategies for determining what quantum should be awarded to certain employees, read Fred Wilson’s tiered methodology and Wealthfront’s model. These are from a U.S . perspective, but still provide a useful starting point.

We would suggest keeping your principles simple and objective. Your approach will of course evolve throughout the life of the company. Options in particular will only be valuable to your employees if the recipient truly understands their potential. This demands communication from the leadership of the highest quality — a worthy goal in itself!