APIs are feeding the financial world

There are over 2,100 Financial APIs according to ProgrammableWeb, a leading API directory. That means more than 2,100 different pipes to capture banking and financial data from the grid! One of these is Plaid and, if ever you needed to get excited about the future of fintech, then look no further. Plaid provides a fast and easy access route to banking data paving the way for a new generation of fintechs. No doubt we have only scratched the surface of how to simplify and organise financial transactions for consumers and businesses. Financial APIs are a key driver for a new generation of successful neobanks, personal finance tools and innovative credit providers. We believe there is still a whole lot more to come and will focus a blog series on exploring the new financial data pipes being laid and the opportunity they are creating for novel fintechs to rise up.

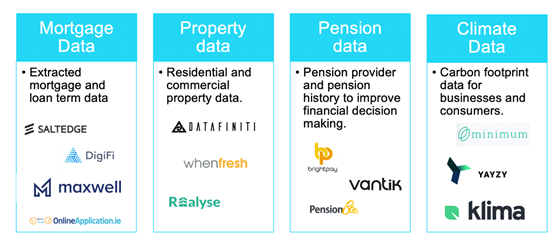

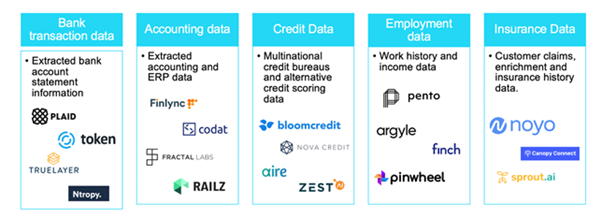

An exciting API landscape

We are continually discovering new data pipes in various financial verticals and have currently identified nine verticals which capture most companies. We are very excited by the way these financial APIs will enable fintech to make the financial functions of businesses and consumers run on autopilot in the future.

How we view infrastructure fintechs

Vertical specialist versus horizontal hero. It can be very tempting to pursue the one-stop shop solution aka a horizontal hero. The teams we meet generally out-class market incumbents with all-star developers who can design/ship new products at an awesome rate, but often these innovators are long on talent and short on focus. Picking a very specific pain point (an API to accept credit cards for example) and going after a targeted audience (see next section) is what we love to see. But more often than not we are approached by teams who have an amazing long-term vision but are lacking the initial hook to start the journey.

We can only believe Confucius was referencing API-first fintechs when he said: “The man who moves a mountain begins by carrying away small stones.”

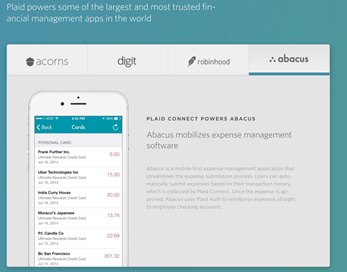

Laser-target your customer. You can never be too focussed as a startup fintech. This is especially true for the type of customer you go after. Take the Plaid example. They targeted small but fast-growing financial management software players and ignored the very tempting incumbents that Yodlee was catering too. This helped them build a community of champions and create a best in class solution for a specific customer base. Plaid is still earning the right to go after large enterprise customers such as Sage but they have a great base and you can still see today how the Plaid V1 product defined and built their core community.

So, if you look at your customer pipeline and you see small, mid and huge enterprise customers in different verticals you just might have a focus problem!

Value creator or cost saver: While there is no right side of the fence to be on, it is important to know which side you are on. And needless to say, sitting on the fence is not a good place to be. Understand the implications of being a value creator or a cost saver to your end customer. Both come with positives and negatives and the sales strategy should be adjusted accordingly. Companies such as Nova Credit and Bloom Credit are value creators as they enable lenders to expand their credit footprint for the types of customers they serve. Value creators can price more aggressively in the early days as they are adding to the top line of customers. When looking at a cost saver such as Canopy Connect or Sprout.ai, you want to look at the operational expenditure implications for the target customers. For insurers, claims processing generally represents 25% of the total opex so the Sprout.ai automation tool can have a material impact on an insurer’s bottom line.

When we think what will catalyse the next generation of fintechs, we focus on the growing infrastructure represented by the 2,100 financial pipes that are being laid as we speak. As investors we want to support these financial engineers as they build the foundation for a bigger and better fintech ecosystem. In the next post we will start to look at what we think next generations of fintechs will look like once the financial APIs have reached scale. In our view, fintech has been built on a passive model thus far with the consumer or business making most of the decisions when it comes to their finances. We will explore a world where your historically siloed financial platforms (think mortgage, payroll, credit rating) are interlinked with APIs enabling consumers and businesses to fly safely with autopilot financial apps integrating services and transactions!