The ins-and-outs of establishing the right corporate entity for your US venture

When to think about US incorporation?

Nearly all companies view setting up a US legal entity as one of the first milestones in entering the US market. It is sensible to take legal advice early, before you start operations in the US, and to take into account the commercial, legal and tax implications of US incorporation.

For most companies, the incorporation process involves two key questions. The first determines the relationship between the existing non-US company and the new US corporation: Will the US will be a parent, a subsidiary, or a branch of your existing non-US corporate entity? We have chosen not to explore this specific question, as it is a technical question that ties closely to a number of legal and accounting ramifications, and is best addressed by working through it with your company’s lawyers.

The second question focuses on the type of corporate entity that can be established and this is the topic we explore below, addressing the following questions:

- When and why to incorporate a US entity?

- Which corporate entity is right for your business?

- In which State should you incorporate?

- How do you incorporate a company in the US?

When and why to incorporate a US entity?

If a non-US company is operating in the US and starts to generate revenues and profit, it will be required by law to pay the applicable Federal, State and City taxes. If the non-US company has a US subsidiary, then it becomes simpler to allocate revenues and costs to this US entity, and therefore reduce the risk that the US tax authorities (the IRS) try to tax the business on a greater proportion of the US and non-US revenues. There may also be other regulatory or legal reasons why a clear demarcation of activity is a sensible idea, for example in financial services or healthcare.

Likewise, on the whole a non-US company should be cautious of hiring US employees directly. It may create a degree of uncertainty from an employment standpoint and arguably creates a US branch of the non-US company. From a legal standpoint, hiring the first US employee is often a strong indicator that the non-US company should establish a US corporate entity.

Other softer but no less material factors to consider are that US companies take a degree of comfort in trading with other US companies (rather than entities incorporated in geographies further a field), and some of the basic commercial infrastructure required to operate here (e.g. a corporate bank account) will require a US corporation. Finally, while this is becoming less of an issue, US venture investors often prefer to invest in a US company rather than a company incorporated outside of the US.

What is the best legal structure for your business?

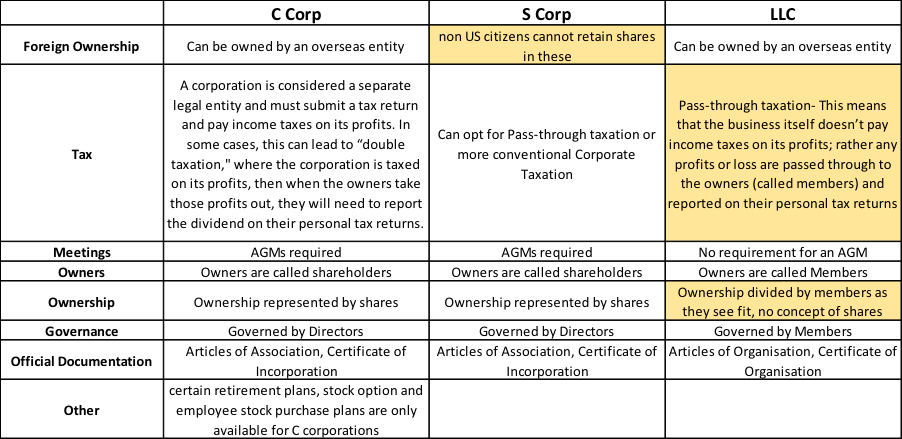

There are different types of US legal entities each with different implications on liability, reporting, ownership and taxation. While the basic structures of a Sole Trader or a Partnership exist in the US, the most common options for high growth small businesses are C-Corporation, S-Corporation or a Limited liability Company. The differences between these are laid out below:

Source: USA-Corporate.com

For many startups the foreign ownership restrictions will eliminate the option of setting up an S-Corporation and the desire to have robust ownership principles and division into stock or shares will eliminate the option of a Limited Liability Company. Likewise, the risk of pass-through taxation creating significant complexity for the non-US parent company may eliminate the option as a Limited Liability Company as a subsidiary. As a result, the C-Corporation tends to be the most popular legal structure for venture-backed businesses and non-US companies looking to incorporate in the US.

In which State should you incorporate?

In the US, a business must choose a specific State in which to incorporate and each State has their own specific regimes around tax, reporting, local regulation and legal process. Where you choose to incorporate will have a direct impact on multiple aspects of your business in the future. Key considerations include:

- Where in the US do you expect your business to operate?

- How established is the corporate law history of a State?

(States with a limited set of legal precedent are seen by some as more risky as legal interpretation and rulings are harder to forecast);

- What are the on-going reporting requirements of the State?

- What are the levels of corporation, sales and franchise tax?

As it happens, the vast majority of Fortune 500 companies are incorporated in either Delaware or Nevada; Delaware being the most favoured within the venture community and for businesses considering an initial public offering (IPO).

Many companies choose to incorporate in Delaware because the State:

- Has a well established set of case law and precedent;

- The new entity can base itself anywhere in the US since advisors US wide will give Delaware corporate advice;

- Has a dedicated Court of Chancery focussing on resolving corporate disputes;

- Does not tax income earned from intangible assets such as trademarks and leases;

- Offers flexibility in the organization of a corporation and the rights and duties of board members and shareholders; and

- Provides greater privacy for director and shareholder identities.

The basic requirements for incorporating in Delaware include:

- Completion of an annual report submitted online;

- Payment of franchise tax: the range is between $175.00 — $180,000.00 and is linked to the number of authorised shares in issue; and

- Maintaining a “registered agent.” See below for an explanation of this term.

How do you incorporate a company in the US?

The process is set out in five steps below. While this looks straight forward, it is sensible to ask the company’s lawyers to handle this process as the cost of a mistake or remedial action may be very significant — for example, there are also on-going obligations on a US company to register and file in each State where it has employees and operations. The typical cost to incorporate a C-Corporation in Delaware is $2-$5k:

- Apply to incorporate in a specific State

- Establish a registered agent in that State

- Submit formation documents

- Maintain registered agent

- Maintain State specific taxation and reporting requirements

If a company incorporates in a State but does not have permanent operations there (for example no employees), it will need to appoint a “registered agent.” This is an additional cost, and is typically under $200 per year. Service providers such as NRAI or BizFilings will fulfil this requirement and will forward mail sent to the registered address as required.

Key Challenges

- Make sure you understand the long-term impact of where you choose to incorporate. Some VC funds for example will only invest in Delaware incorporated corporations;

- Be cautious of handling this process yourself — it may save you a small amount of money in the immediate short term, but the cost of getting this it wrong and taking remedial action could be substantial; and

- Consider the wider parameters of regulation and taxation when forming your view on the optimal US State for incorporation. Again, the company’s lawyers are best placed to help you work through this decision process and inform you of the latest considerations.

Where to go next

- The differences between an LLC and a Corporation;

- Articles on the reasons to incorporate in Delaware (1, 2, 3,);

- Some companies use tools such as VirtualPostMail for digital mail forwarding

- How to incorporate in the US from outside the US geographies; and

The following lawyers offering services for incorporation in the US:

- Tom Michael, Dentons;

- Daniel Glazer, Wilson Sonsini;

- Ted Rosen, Fox Rothschilds.

We hope this blog has provided a useful introduction to this area. As you might expect, the US market is dynamic and evolving all the time, so we encourage all companies to take specialist advice. Please do share this blog and use the comments section to highlight your own experiences if these differ from the above. Alternatively email me or Alliott directly. Many thanks to Tom Michael of Dentons and Daniel Glazer of Wilson Sonsini in helping us to formulate our thoughts and correct our misunderstandings on this topic!