What is a PEO…

Professional Employment Organisations or “PEOs”

Professional Employment Organisations, known in the US as “PEOs”, enable businesses to purchase healthcare for their employees quickly and easily. They also offer a Company a range of other useful services such as payroll and payroll tax administration, compliance with Federal and State employee filings, Workers’ Compensation, and the provision of various other additional benefits such as Employee Handbooks, pension plans, and supplementary healthcare such as dental and vision insurance.

When to use a PEO

One of the reasons a PEO is attractive to smaller companies is that it offers the opportunity to contract with a single vendor for a number of services. PEOs are also popular in the US because health insurers offer better healthcare policies to companies with more than 50 employees (“large group” companies). By using a PEO, a company with less than 50 employees can leverage the group buying power of the PEO to gain access to these better insurance policies. The drawback of this is that your employees must be co-employed by the PEO, not your company. While to a European audience this may seem like a significant issue, locally this is a technicality and not something to get caught up on — particularly if it results in better healthcare for the employee. Typically the only sign of this “co-employer” relationship will be on the employee payslip.

When a business gets to 50+ full time employees there starts to be a stronger case to negotiate a more specific, bespoke set of healthcare policies with a broker: the premiums of a small group insurance policy can sometimes be less than the insurance rates + administrative fees provided by a PEO. Some PEOs (e.g. Sequoia Benefits) even go one step further and help businesses migrate away from their initial set of services in a staged manner (e.g. continuing to manage payroll but enabling healthcare to be serviced elsewhere). Other PEOS are less amenable and encourage retention to their services by making a divorce a little more complex — see Pitfalls to Avoid below.

Example PEOs

From a data set of over 200 VC-funded US startups, the distribution across the various providers was Sequoia (30%); Trinet (12%); Zenefits (11%); ADP (6%); Sweet & Baker (2%); and ProInsurance (2%). A more recent entrant to the market is the NY founded JustWorks which also garners good reviews.

From talking to clients of the above service providers, companies should look to pay on a per-head basis with an initial integration cost. This per head rate can vary from $100–200 per month in addition to the cost of the healthcare policies provided to the employees.

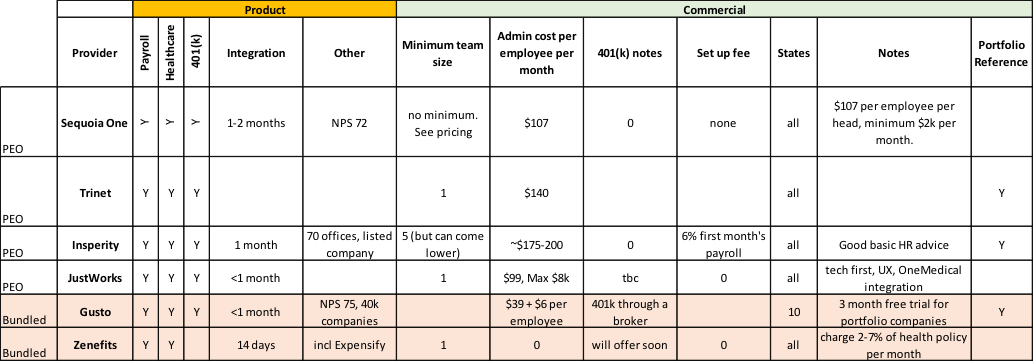

The below table lays out key variables between the main providers:

Octopus Ventures, 2016

[Non PEO] Insurance Brokers

There is also another flavour of service provider which aims to bundle payroll services, health insurance and employee compliance. The main contenders here are Gusto and Zenefits. These firms are in many ways similar to insurance brokers.

Under this model, the vendor is a broker and will help your company contract with a blend of third party service providers. Zenefits becomes your broker of record but has no control over the cost of the benefits themselves. However, they do not charge an administrative fee for this service and your employees do not go under their unique tax identity as employer of record. Their system is easy to use and making a transition to them is simpler because you can keep your existing benefit plan. This also provides minimal impact for your employees in terms of managing change.

One downside to these vendors is that is they do not offer co-employ like the PEOs, so if your company has less than 50 employees, the quality and price of some healthcare plans and 401(k) programmes they distribute to their clients can often be lower than what you might see from a PEO.

Another downside is that much of the work of implementation and maintenance will fall to your company and there is a small risk that you cut corners unknowingly. For instance, while you may only intend to have a small team initially in the US, for each employee, specific tax filings must be made, often with specific adjustments, varying by State, County and City (in addition to the Federal filings). Sound complex? It certainly seems to be.

Finally, the PEOs would argue that they are incentivized to make sure your Company is set up correctly because the PEO does things on your behalf using their own unique tax identity. It is therefore in their best interest to make sure you are fully compliant, otherwise they are liable. With the Zenefits model, your Company is liable for any mistakes you make (filings you forget to make, etc.) and some reports suggest that approximately a third(!) of businesses are each year fined for payroll and compliance mistakes in the US.

Our sense is that this area of employee compliance presents an avoidable, complex and significant workload if carried out by your company. As a result of this, if you opt not to go with a PEO, the significant majority of companies choose to use a payroll provider which will manage all the compliance issues and individual filings.

A US payroll provider will typically provide the following services:

- Employee tax filings in any required state

- Basic regulatory guidance

- Updates on changes in company requirements or regulation

- Integration into other benefits providers and platforms e.g. Zenefits or other providers offering pension plans (401(k)s) or healthcare contributions

From a sample of 250+ US venture backed businesses, the distribution across major service providers was ADP (47%); Trinet (12%); Paylocity (8%), Paychex (7%), Gusto (6%) and Quickbooks (4%).

Key questions and some pitfalls to avoid

- How do the PEO’s fees scale as your US team grows? PEO charging rates are not always as clear as they could be and some providers tie their fees to a percentage of payroll. Ensure you understand this up front ahead of time.

- What other fees may you incur? Make sure you are aware of any “special fees” or fees mentioned in the small print such as re-running payroll or changing employee details.

- Can your employees update their information on their own, electronically? Not all PEOs offer this. In some cases, you will have to fax or mail forms into the PEO.

- Is the PEO licensed in the State(s) where your employees will be? If you plan to have remote employees, you should make sure these locations are covered.

- What is the minimum number of employees in your team the PEO will service?

- What happens if you wish to change vendor or wish to change vendor for a subset of the service (e.g. pension plans / 401(k))?

- Where does the liability lie for non-compliance? Understand how liability is split between the PEO and your company — as both parties share in liability which can work in both directions.

- If not going the PEO route, is the business capable of managing State-by-State employee payroll regulations in-house?

- If not going the PEO route, would you consider using a payroll provider that is separate from a PEO like Gusto, ADP or Paychex?

- How strongly do you feel about employing your team directly? This may lead you to consider Gusto or Zenefits.

- Is an automated solution sufficient or do you need an outsourced CFO function?

Where to go next

- Check out our selection of product details from a range of service providers in our Dropbox

- Average contribution data for healthcare

If you want to get specialist advice or more information on this topic, we would suggest speaking to:

We hope this blog has provided a useful introduction to this area of US benefits. As you might expect, the US market is dynamic and evolving all the time, so we encourage all companies to take specialist advice to determine what is the optimal blend of healthcare to fit their needs and circumstances.

Please send us your thoughts on the above and to highlight your own experiences if these differ from the above. Alternatively email Will or Alliott directly.

Thanks to Mark & Jed at Sequoia Benefits, Gregory at Kranz Associates Cassandra at Trinet, Dorothy at Insperity, James at Elliptic, Jon at Amplience and Stuart at BAB Leap for your help and guidance in pulling this blog together.