Deep Dive: Cannabis

The world of medicinal cannabis and the next 5-10 years of development in the UK is far from simple. A lot of the challenges in the UK are also relevant to other geographies where cannabis is not recreationally legal or where the medical community or payers still require additional support.

We believe that the most interesting areas for innovation are:

- Removing friction in prescribing. This includes clinician education, real world evidence collection and dosage management. (E.g. ProjectTwenty21 or companies like Alta Flora)

- Increasing consistency in cultivation and narrowing the gap between natural products and licensed pharmaceuticals. This includes synthetic production of cannabinoids, novel industrial processes and therapeutic developers. (e.g. OCT, Sanity Group, Grow)

- Managing the supply chain. This includes quality assurance, supply chain traceability and compliance management. (e.g. Metrc)

- The role of private clinics specialising in cannabis prescribing. Will the NHS look to refer patients out to private specialists or will demand for these clinics crumble when the data is such that NHS clinicians can confidently prescribe at scale? (e.g. The Medicinal Cannabis Clinics)

The main questions and trends that we are paying most attention to are:

- Level of comfort for UK clinicians to prescribe and what they need to see to get as comfortable as their German counterparts

- The opportunity for internationalisation of success businesses overseas into more nascent markets, or whether more nervous regulators will look for local solutions

- Whether there are still elements of the value chain where innovation can support £1bn+ companies that can grow with the market e.g. synthetic production approaches.

Today’s landscape

The NHS is only writing 1-2 prescriptions a month, while Germany is showing us how it’s done when the evidence, regulation, and clinicians pull in the same direction

Prior to 2017 the regulations in Germany were much the same as in the UK or other European countries, but since a review which meant that doctors could prescribe medicinal cannabis, subject to some requirements being met, and insurers being supportive, Germany now represents over 70% of European cannabis sales with approximately EUR 170m of sales in 2019, albeit having any accurate view on this number is challenging. In December 2019 alone, German health insurers paid out EUR13m to cover the cost of medical cannabis products, with approximately 50% of that being for unprocessed flowers. For context, there are two main categories of medical products derived from products; authorised and licenced finished drugs (comparable to Aspirin) and Cannabis preparations which include unprocessed flowers and extracts.

Taking data from the Canadian medicinal cannabis market with a population of 37 million people and with approximately 330k registered medicinal cannabis patients (1% of the population) would give an average cost per patient of £881. Transposing the same proportions and pricing to the UK would give a £500m medicinal cannabis market and £650m in Germany; in many ways Germany may just be at the start of this trend! Many market commentators would also say this is a conservative view and the more likely market size may be more like 3x this level in the next 5 years.

The UK numbers are perhaps a more complex story. In November 2018 Cannabis was re-scheduled as a substance from Schedule 1 (alongside Ecstasy and raw Opium) to Schedule 2 (alongside peers such as Cocaine, amphetamine and methadone). This was the result of a huge amount of lobbying and political pressure – much of which rallied around the emotive story of Billy Caldwell, as a treatment for his severe epilepsy.

Whilst this was seen as a turning point, in that after the MHRA re-scheduling doctors could prescribe medical cannabis as an unlicensed “special” treatment if all other options had been exhausted, this in effect did very little to the level of prescriptions. Looking at data from early 2020, only approximately 25 prescriptions per month were being issued in the UK and with only 1-2 per month through the NHS. Compared to the Canadian benchmark of 1% of the population getting clinical benefit from medicinal cannabis, the UK prescription number represents 0.005% of those who could benefit (i.e. 550k potential patients). To put this in context, this is the same as the whole of the UK population being eligible to benefit from a treatment but only Tesco employees receiving it – this is what 0.005% of an eligible population looks like! The potential in the UK when regulation, clinicians and data pull in the same direction is immense and sadly those that will benefit most are those in really challenging medical situations e.g. chronic pain, cancer patients, substance addictions, MS or epilepsy.

Why the UK drag?

Lack of quality data

One of the main reasons for low UK support in prescribing cannabis is the lack of quality data, but this is quickly changing

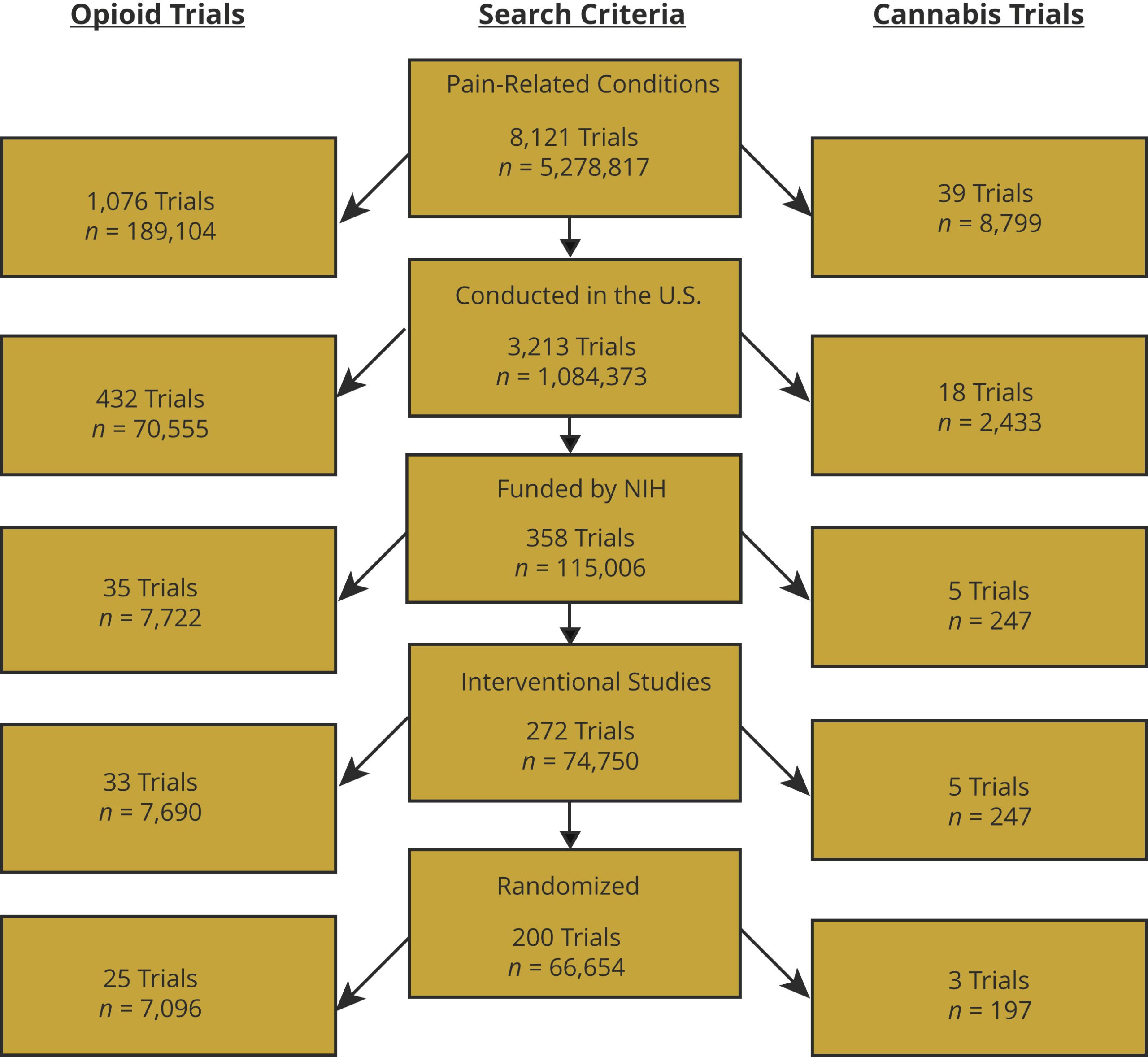

One study in 2019 made a comparison between the number of robust clinical studies around the use of opiates over a 10-year period versus the number of equally robust studies looking at cannabis. The result of this comparison was that whilst there were robust studies looking at the medical impacts of cannabis, the number was very small with over 8 times as many trials with robust methodologies looking at opiates (3 cannabis trials versus 25 in opiates).

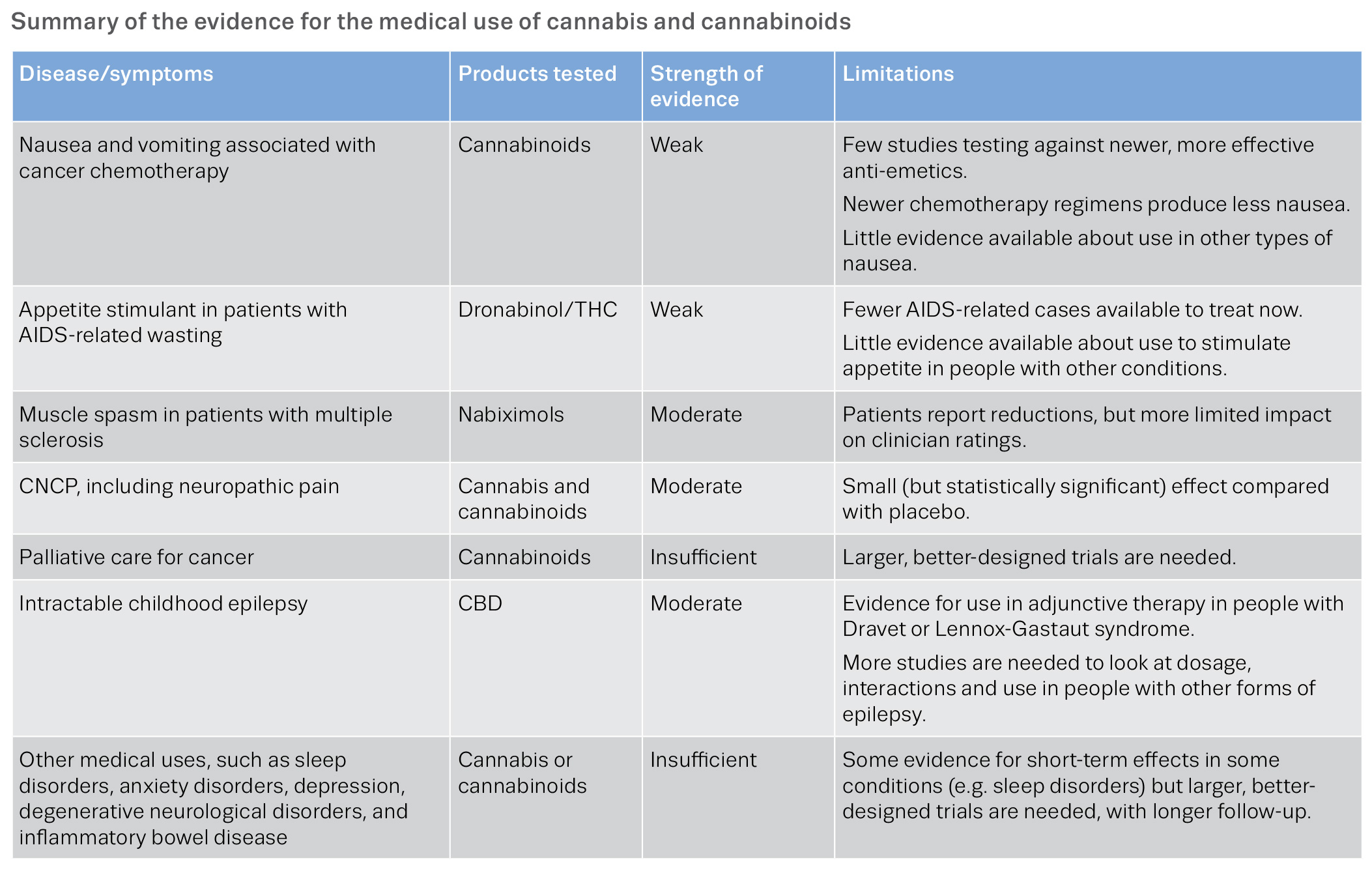

A perspective from the European regulator on the topic of clinical data quality was given by the European Monitoring Centre for Drugs and Drug addiction in 2018 (8) which tells a very similar story of perceived low quality data around the medical effects of cannabis:

https://www.emcdda.europa.eu/system/files/publications/10171/20185584_TD0618186ENN_PDF.pdf page 16

Quality of sample data

Equally, in the latest guidance from NICE around the prescription of medicinal cannabis it is also very consistent in its view of low quality of sample data for virtually every application of medicinal cannabis outside the use of Sativex and Epidiolex, the only licensed pharmaceutical cannabis derived drugs in the UK currently.

This desire for more robust data sets has led to many exciting new studies to take this blocker off the table. The most prominent of which is the Twenty21 study which will see up to 20,000 patients prescribed medicinal cannabis with subsidised costs to increase uptake, issued via private prescribers and with the results accurately recorded. The ultimate value in this trial is in collecting very granular data around patients, dosages, and side-effects. It is hoped that a data set of this size will give clinicians, regulators and NICE the data they need to review their guidance and cultural outlook on prescribing cannabinoids in line with international peers. The recent NHS announcements of a national registry on patient data for cannabis prescriptions is also a step in the right direction.

Regulated value chain

The value chain for a highly regulated substance like Cannabis, with additional political interest, is a complex and expensive one which also hampers rapid adoption

Having recently started the process myself to get a prescription for medicinal cannabis privately to help with troubled sleep, I can vouch that the current process and financial cost to patients is material. There are just over 20 private clinics in the UK with prescribing licenses for medicinal cannabis but with under 100 new prescriptions a month in aggregate it is hard to see how the maths currently works for this to be a sustainable business for these dedicated clinics. For my initial consultation this involved a £70 up-front fee with the expectation that the prescription would likely be £150 a month. This is clearly not cheap but when you think that in order for me to get my prescription, I need to have an initial consultation, the physician needs to be confident that I have exhausted all other available routes after requesting and reviewing my medical history, and then make a recommendation to the MHRA who will approve or reject my prescription, this is a complex process which will of course have a cost attached to it. Patients for whom cannabis may be appropriate have the option of finding a NHS clinician who will prescribe an unlicensed drug (good luck!) or pay-up and pursue the private route where the openness to prescribe is much higher.

It’s not just the complexity to get a prescription, the costs for pharmacies to obtain a cannabis delivery, then manage and store a “controlled scheduled 2 substance” is also one where additional complexity will be reflected in additional cost to the patient or payer. Incidentally, a recent change to the charging tariffs in Germany will see the broadly accepted 100% markup on unprocessed cannabis charged by pharmacists, and previously supported by regulators, be reduced. In the UK, an additional nuance to the current regulatory situation means that pharmacies cannot hold stock of unprocessed cannabis in anticipation of it being required. Rather, for every prescription they are presented with they have to send off and have the prescription made bespoke. This is quite different to Germany where approximately 25% of German pharmacies can prescribe and stock unprocessed cannabis.

The requirements for traceability, compliance and supply chain management in the US have led to the rapid growth of a number of US companies managing this risk and working closely with regulators and government. Metrc (Marijuana Enforcement Tracking Reporting & Compliance) for example has raised $50m in venture funding and claims to be the most trusted approach and used in more US states than any other solution. It will be interesting to see how the European landscape develops and whether established US businesses bring their turnkey solutions or whether locally grown approaches will be favoured by governments.

Without considerable change in the regulatory requirements around Cannabis, it is hard to see how the costs and process for patients will meaningfully change when it comes to prescribing unlicensed cannabis products as a treatment.

Managing dosage

Managing dosage is far from straight forward and will provide another opportunity for innovation both in the clinic and the lab

Unlike a licensed or authorised finished pharmaceutical drug which will have a very accurate and consistent strength or concentration (e.g. aspirin or paracetamol), it is a more complex approach with unprocessed medicinal cannabis which is typically grown in a greenhouse rather than a bioreactor. Looking at the prescription data from Germany over 50% of prescriptions are for unprocessed flowers. A lot of the commentary from experts has been that this is due to the “entourage effect” by which there is a compounding effect when multiple cannabinoids contained within a single plant are combined, that is to say, there is benefit in a fully natural and unprocessed product. Many sophisticated companies such as Celadon are using advanced techniques to refine specific strains or cultivars to ensure optimal composition of flowers and increase consistency but compared to entirely synthetic production of a drug in a lab or factory, this route will likely always have a degree of natural diversity which will have fundamental issues for scaling unprocessed flowers as a mainstream prescription treatment.

This interest in reducing the diversity in composition if patients are to be prescribed cannabis flowers will perhaps reduce over time in the event that more licensed pharmaceuticals are available and pharma product development catches up with demand. As mentioned above, in the UK GW Pharma has the only licensed Cannabis-based pharmaceutical products for the treatment of epilepsy and spasticity. Perhaps when GW and other therapeutic developers such as Oxford Cannabis Technology bring additional treatments to market this pressure on driving consistency in flowers will reduce.

Seeing the largest cannabis companies in the world partner with novel biotech companies in order to synthetically produce cannabis, largely through biosynthesis is not a new approach in many ways. This can be seen with Hyansinth Bio in Canada or Ginkgo Bioworks partnering with Chronos to deliver biomanufacturing by “transferring DNA sequences…to organisms such as yeast and E. coli” in order to culture specific cannabinoid combinations at scale. In a summary of their work on the topic, Ginkgo also draws parallels with Asprin, which started as an extract from a willow tree but is now produced in a reaction with yeast which can give a very high degree of consistency and produced on a global scale that can sustainably match demand.

Seeing vaporiser companies such as Indose in the US, who look to measure specific dosages from isolate or flowers with a device linked to a user’s phone, or from the growing research – it is clear that the theme of ensuring precision in prescribing is one that is an important blocker to adoption. In the absence of finding new ways to ensure consistency and repeatability, physicians will have to wait until the world of licensed medications catches up with patient interest, which feels an underwhelming outcome for those desperate to get access to medicinal cannabis.

The future

We have had some fantastic conversations with clinicians, entrepreneurs, economists and patients on the topic of medicinal cannabis and the more we dig into this topic the more we are convinced that there will be many European medical businesses that will be built out of the growing acceptance of the clinical value of cannabis in its many forms. This is a topic where the stake holders, incentives and interests are complex and range from IP protection, supply chain robustness and quality of clinical studies. After policy makers, it feels like the most powerful stakeholders at the end of the day are clinicians and giving them all the tools they need to prescribe medicinal cannabis at scale. One of the best forecasts I heard on this topic was that when prescribing cannabis can look like prescribing any other medication and there are no special additional checklists for doctors to complete then it will be widely prescribed. I also agree that pharmaceutical cannabis products, much like those produced by GW Pharma or smaller challenger therapeutics developers, will be the future of how patients will unlock the value from cannabis but until the data and studies have been completed, the world of unprocessed and unlicensed cannabis will have a role, albeit one that will likely decrease over time.

Sources

MJbiz 2020 market report

https://www.statista.com/statistics/603356/canadian-medical-marijuana-clients-registered-by-quarter

https://www.sciencedirect.com/science/article/pii/S1098301519321990

https://www.emcdda.europa.eu/system/files/publications/10171/20185584_TD0618186ENN_PDF.pdf

https://www.nice.org.uk/guidance/ng144/chapter/Rationale-and-impact

https://www.labiotech.eu/interview/medical-cannabis-regulatory-patient-demand-pricing-germany/

https://www.ginkgobioworks.com/our-work/producing-cultured-cannabinoids/